We often hear terms like agile framework, growth mindset, or company resilience and versatility, but what do these mean in practical terms? While businesses have shifted from taking customers for granted to embracing relational models, it’s crucial to ask: Have we overlooked the foundational element of these relationships? Despite our reluctance to acknowledge it, the transactional relationship remains the cornerstone of business, ensuring a company’s survival and ongoing viability.

Startups and less mature organizations frequently depend on equity-sourced capital for growth, investing heavily in customer acquisition strategies at the top and middle of the sales funnel, often without data-driven guidance. There has been considerable emphasis on managing expenditure, yet the critical aspect of the transactional relationship, particularly in terms of largely ignored inbound revenue.

The Core Tenet of Business

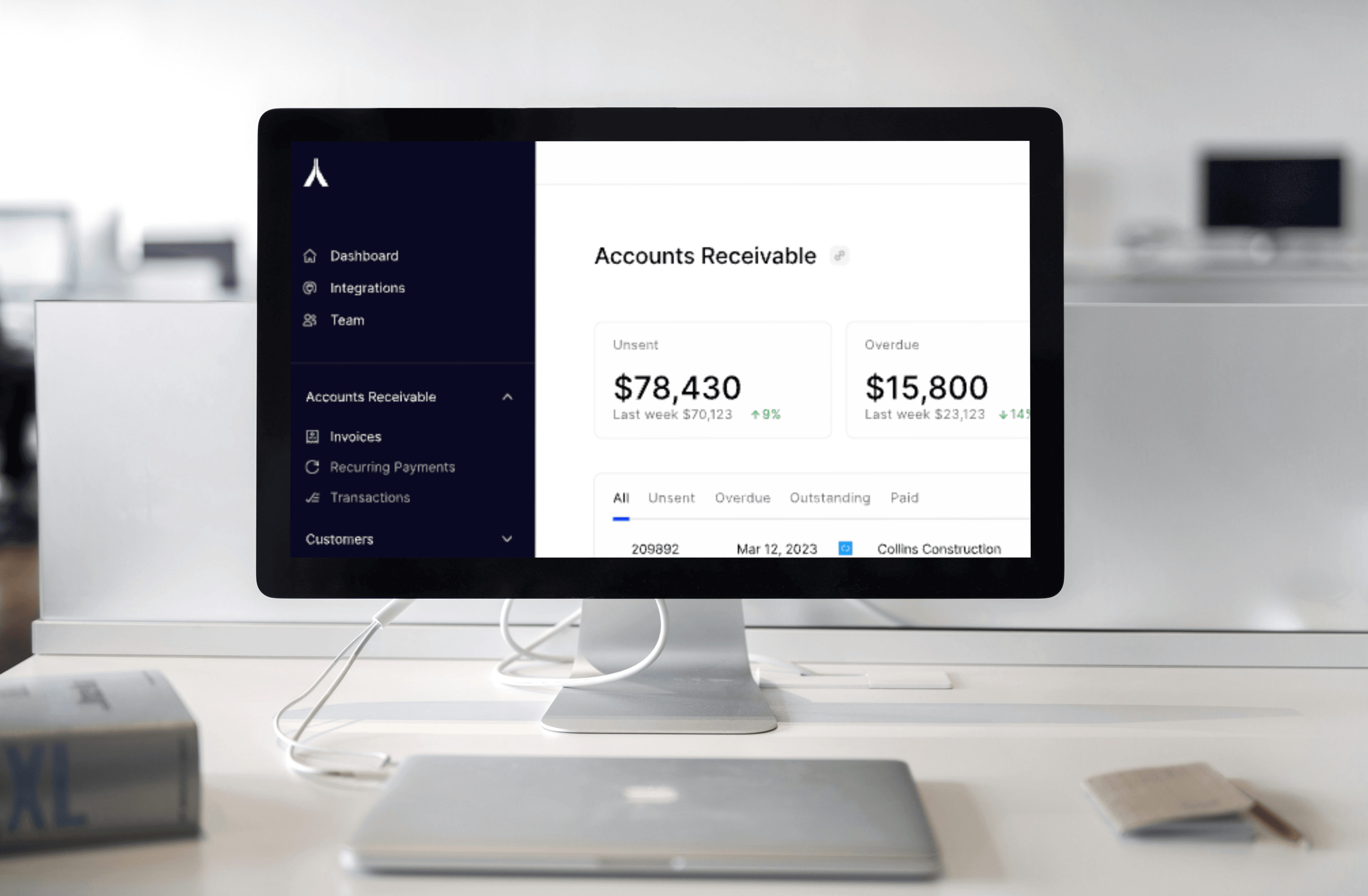

Reaching an agreement, whether verbal or written, and the subsequent collection of payments are often absent from the structured processes one might expect. The handling of accounts receivable is often informal. This may stem from a venture capital culture that induces financial management complacency, aggressive growth strategies, or inadequate governance over essential business operations. Consequently, a misalignment between bank account balances and actual cash flow has created a dysfunctional dynamic.

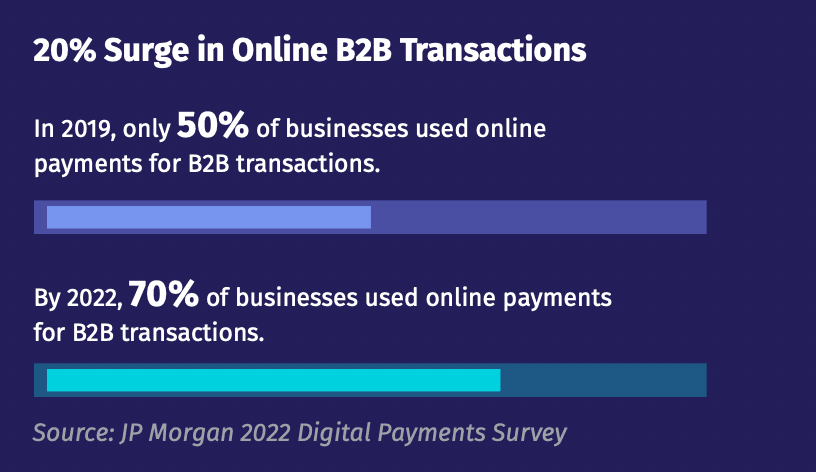

The undeniable truth is that accounts receivable, or incoming funds, represent a business’s most significant line item in this critical yet neglected area. Establishing a robust process for money collection is becoming more crucial than presenting an alignable company culture. B2B payments are assumed to be automated, reflecting the widespread automation and digitization in the world.

Flexible Payments Disrupting Traditional Banking

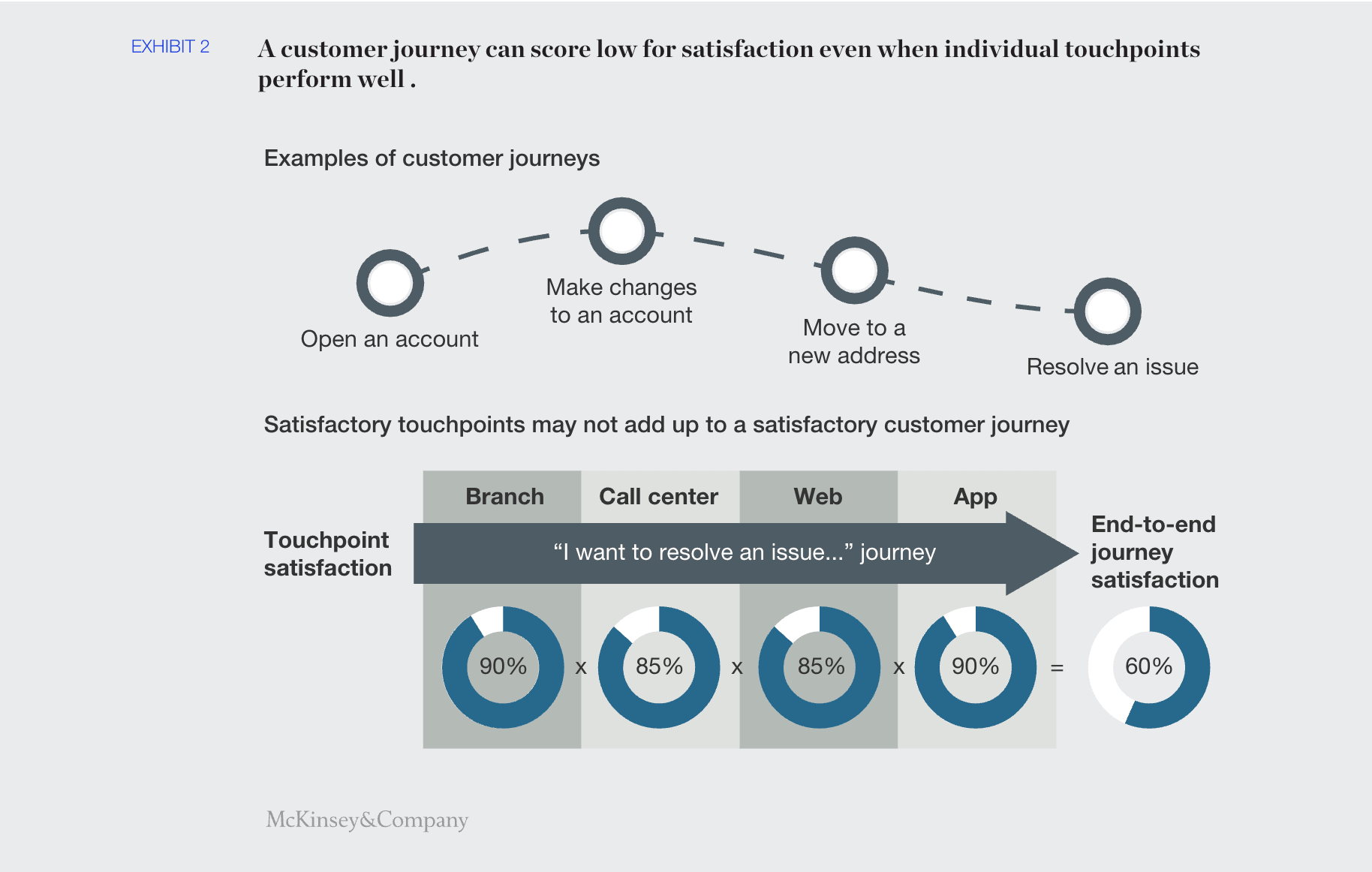

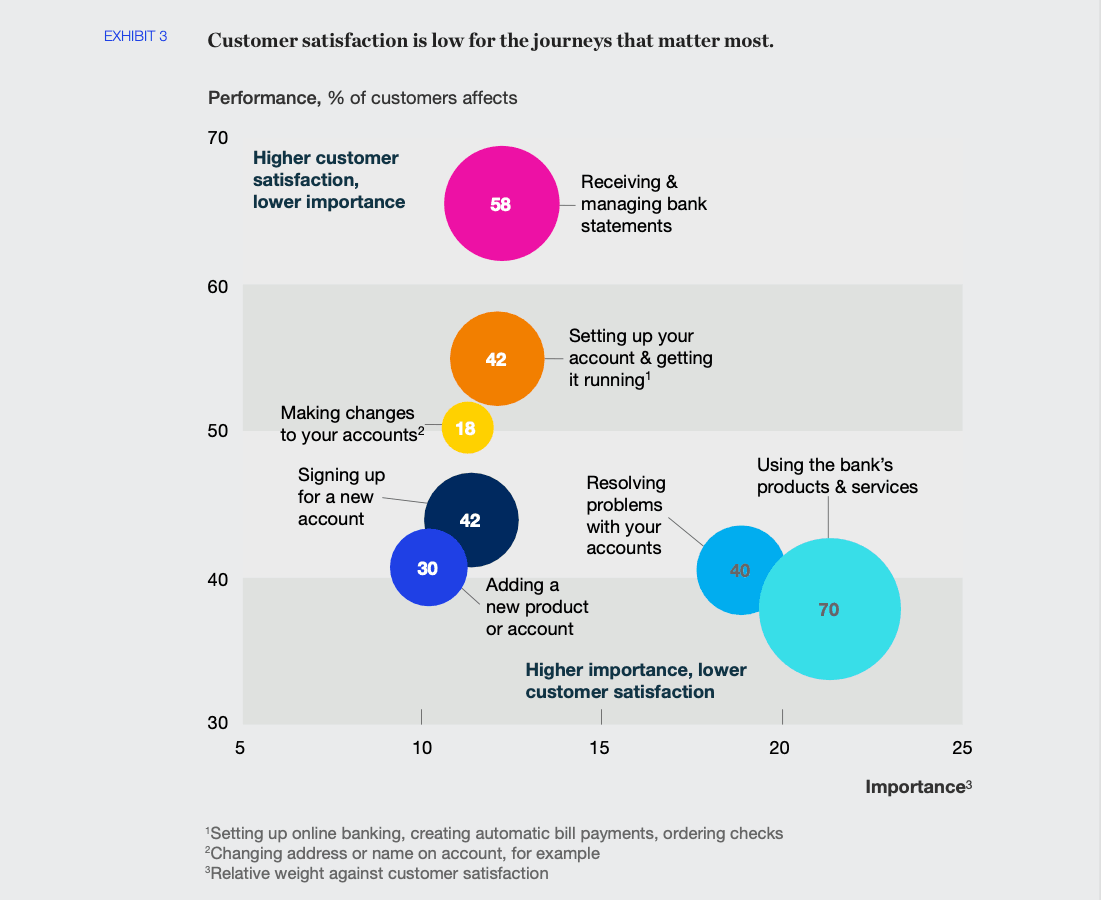

Today’s competitive landscape requires businesses to be agile. In the customer experience sphere, business model flexibility integrates network influence, transactional relationships, and corporate ownership to meet evolving customer demands. A McKinsey study highlights US banks’ customer satisfaction shortcomings, a challenge common across industries. For instance, a telecom provider improved its digital interfaces, enhancing customer experience and setting new efficiency standards by significantly reducing sign-up times.

Delving into data reveals customer satisfaction’s significant impact on business outcomes. In banking, satisfied customers are seven times more likely to increase deposits and twice as likely to open new accounts than those who view services as average. Similarly, in the pay-TV industry, satisfied customers tend to stay subscribed to their service provider twice as long as unsatisfied ones. These insights emphasize customer satisfaction’s crucial role in building loyalty and long-term relationships — critical for remaining competitive and sustained revenue growth.

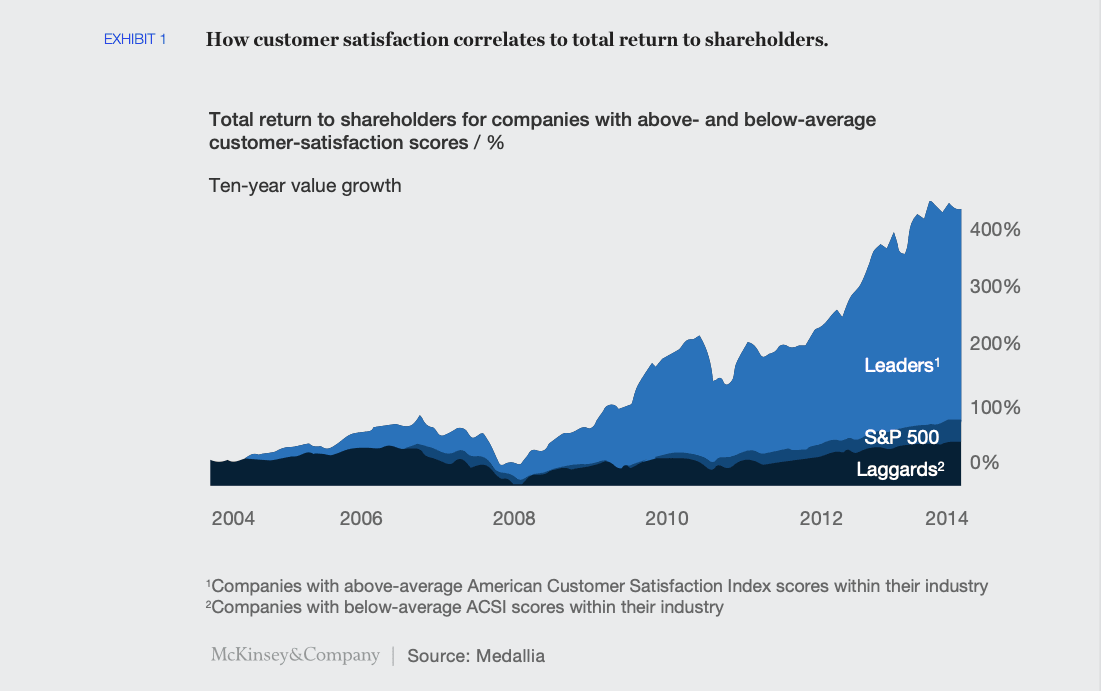

Moreover, customer satisfaction significantly influences shareholder value. Companies with high customer satisfaction scores see a fourfold increase in total return to shareholders over a decade compared to those with low scores. This data highlights that enhancing customer experience is crucial for loyalty, financial performance, and shareholder value. Businesses need to understand and optimize the customer journey, aligning operational improvements with insights to ensure positive individual interactions lead to overall satisfaction and business success.

These insights stress the need for businesses to revise their operational models, showcasing how flexible payments can transform a business by simplifying customer journeys and integrating digital solutions. Businesses can significantly improve customer satisfaction, loyalty, and overall success by offering adaptable payment options that align with customers’ digital expectations. As we explore flexible payments’ benefits, it’s vital to focus on this goal of simplification and customer-centric innovation, which drives transformative results across sectors.

Digital Wallet Adoption in the South Pacific

Transactional relationships, rooted in reciprocal exchange, are fundamental to this flexibility. The case of mobile wallet adoption in Singapore illustrates how technological advancements in payment methods can significantly influence business growth. By facilitating smoother transactions, mobile wallets have proven to boost sales, especially for SMBs, showcasing the direct impact of payment flexibility on business performance.

Moreover, the importance of financial flexibility is highlighted in the context of credit accessibility for small firms in developing regions. This same report cited an example from Bangladesh demonstrating how companies offering repayment flexibility can substantially improve client outcomes. This underscores the potential for flexible financial products to foster entrepreneurial growth and mitigate risk.

Flexible Payments Applied In-Practice

As businesses increasingly acknowledge the strategic benefits of flexible payments, they can harness this adaptability to secure a competitive advantage. Here’s an in-depth look at how flexible payments can drive business growth and enhance customer engagement:

- Enhancing B2B Transactions: Traditional credit lines can strain businesses in this high-interest economic climate. Offering customizable payment terms during sales negotiations can be a game-changer. Flexible payments simplify transactions, allowing for more personalized payment arrangements that align with different businesses’ financial workflows. This flexibility can reduce friction in the sales process, improve partnership trust, and accelerate buying cycles.

- B2B Buy-Now, Pay-Later (BNPL): Incorporating BNPL in B2B contexts can revolutionize sales by countering the “let’s wait until next quarter” objection. This model aids businesses in managing cash flow while securing necessary goods or services. Offering deferred payment options can attract customers who defer purchases due to immediate financial limitations, thereby shortening sales cycles and boosting sales volume.

- Optimize Accounts Receivable: Combining BNPL with accounts receivable automation enhances payment collection efficiency and addresses sales timing objections. This approach accelerates cash flow, improves financial predictability, and reduces credit risk, benefiting overall business resilience.

- Streamline Accounting Processes: Flexible payment integration can minimize manual reconciliation and reduce administrative burdens, enhancing financial efficiency. Simplifying accounting processes benefits providers and customers by improving experience and operational efficiency, leading toward a predictable revenue model.

- Subscription Revenue Model Simplified: Payment flexibility is crucial for subscription models, catering to customers’ varied billing preferences. This adaptability can reduce entry barriers, diminish churn rates, and enhance customer lifetime value. Enabling initial payment deferral can widen the customer base, fostering increased adoption and retention, for a subscription service’s success.

- Boost Customer Success: Flexible payment schedules in B2B transactions align with customers’ financial circumstances, enabling better cash flow management and purchase timing. This flexibility enhances the customer experience, fostering loyalty and encouraging repeat business.

- Unlock the Potential of Banking as a Service (BaaS): BaaS platforms offer tailored financial services online, providing customization beyond traditional banking. Integrating flexible payments with BaaS can attract businesses seeking innovative financial solutions, heralding a new era in financial service innovation.

By adopting flexible payment strategies, businesses respond to current market demands and position themselves as forward-thinking and customer-focused. This approach can expand market share, enhance customer satisfaction, and drive sustained growth. Flexible payments are a strategic asset, promoting customer loyalty, efficient cash flow management, and operational excellence in a dynamic economic landscape.

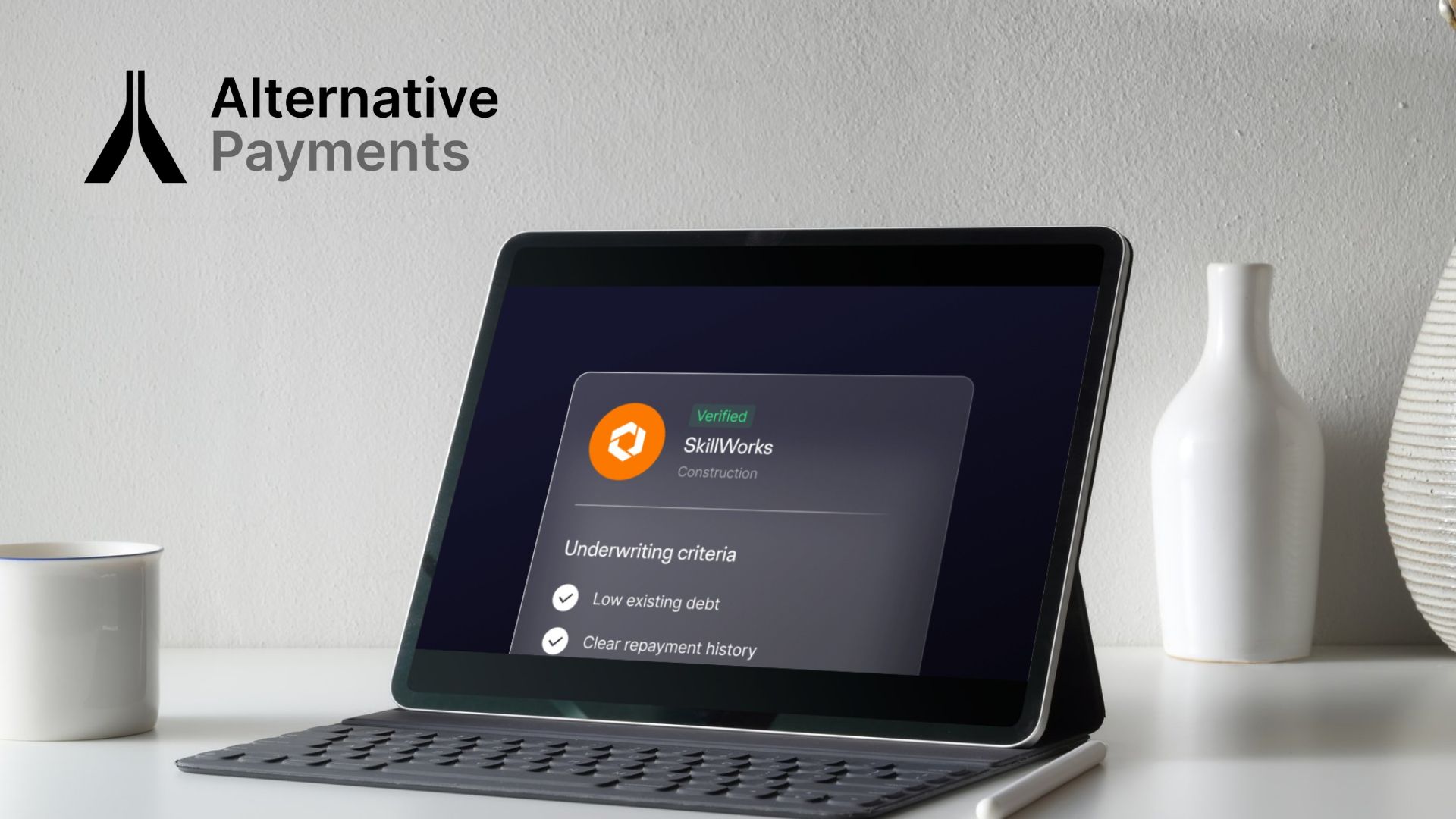

Discover how Alternative Payments can revolutionize your B2B transactions with agile, fast solutions that enhance the efficiency of your customer experience and accelerate your growth engine.