Successful accounts receivable management is critical to the financial foundation of your business. By implementing proactive strategies for tracking payments, addressing overdue invoices, and streamlining the invoicing process, you can ensure that your business remains financially secure and resilient. These five hacks will help you elevate the financial operations of your business.

Five Hacks to Optimize Your Accounts Receivable Management

- Establish Clear Payment Terms: Set clear and concise payment terms with your clients from the outset. Ensure these terms are communicated clearly on invoices and any other billing documents. This helps avoid confusion and ensures that customers know when payment is expected.

- Implement Automated Invoicing: Automating your invoicing process can streamline operations and reduce the likelihood of errors. Utilize accounting software or dedicated invoicing tools to generate and send invoices promptly. Automation also allows you to schedule reminders for overdue payments, improving your collections process.

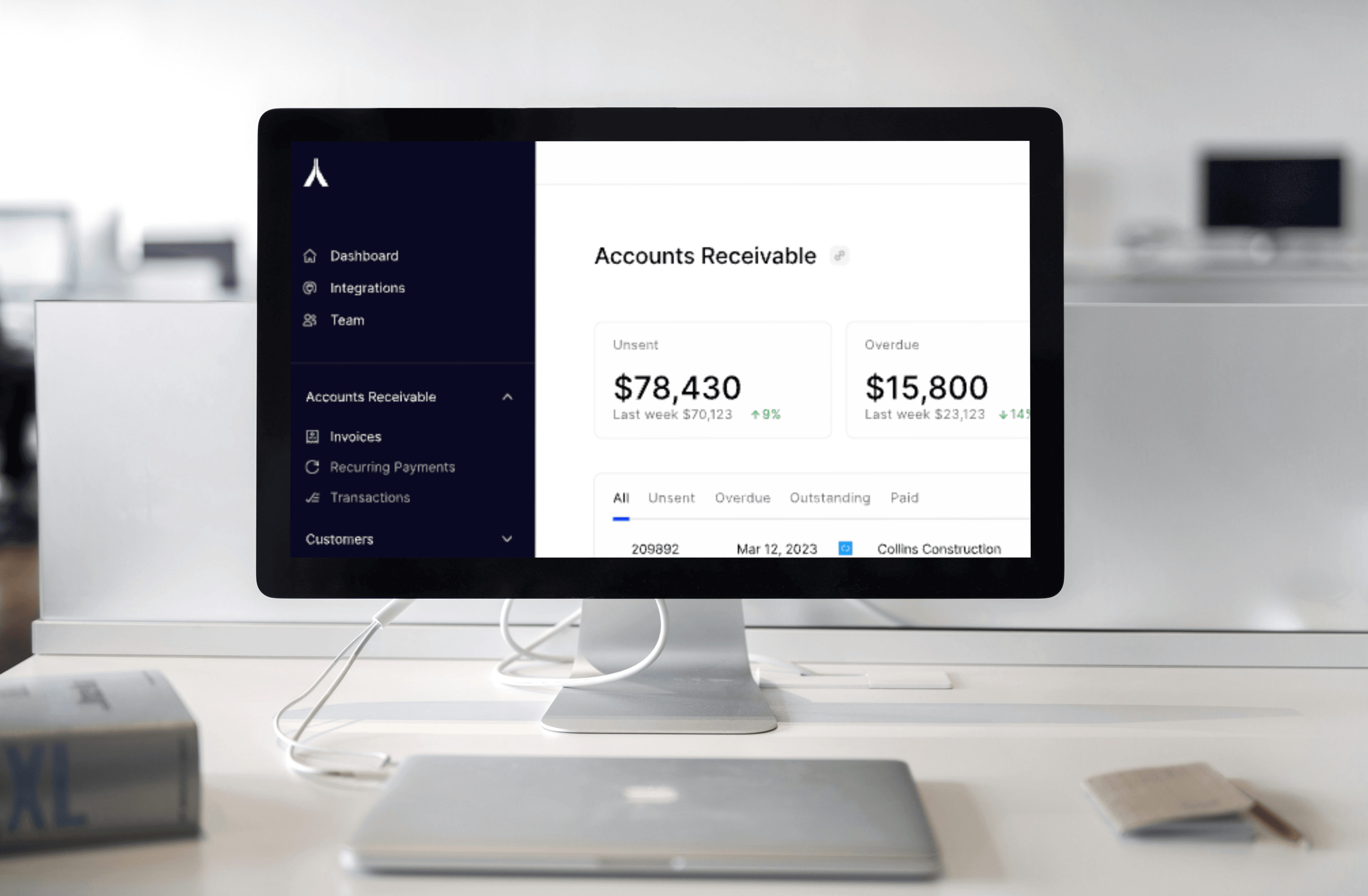

- Review Aging Reports: Stay on top of your accounts receivable by regularly reviewing accounts receivable aging reports. These reports provide insights into the status of outstanding invoices, helping you identify overdue payments and take appropriate actions, such as sending reminders or initiating follow-up calls.

- Establish a Collections Policy: Develop a collections policy outlining the steps to be taken in the event of late or non-payment. Clearly define escalation procedures, including when to involve a collections agency or pursue legal action. A structured collections policy helps maintain consistency and professionalism in debt recovery efforts.

- Offer Incentives for Early Payment: Encourage prompt payment from customers by offering incentives such as discounts or rewards for early settlement of invoices. This can motivate clients to prioritize your invoices and expedite payments; thus, improving your cash flow.

Implementing these hacks can enhance your accounts receivable management processes, minimize payment delays, and improve your financial performance.

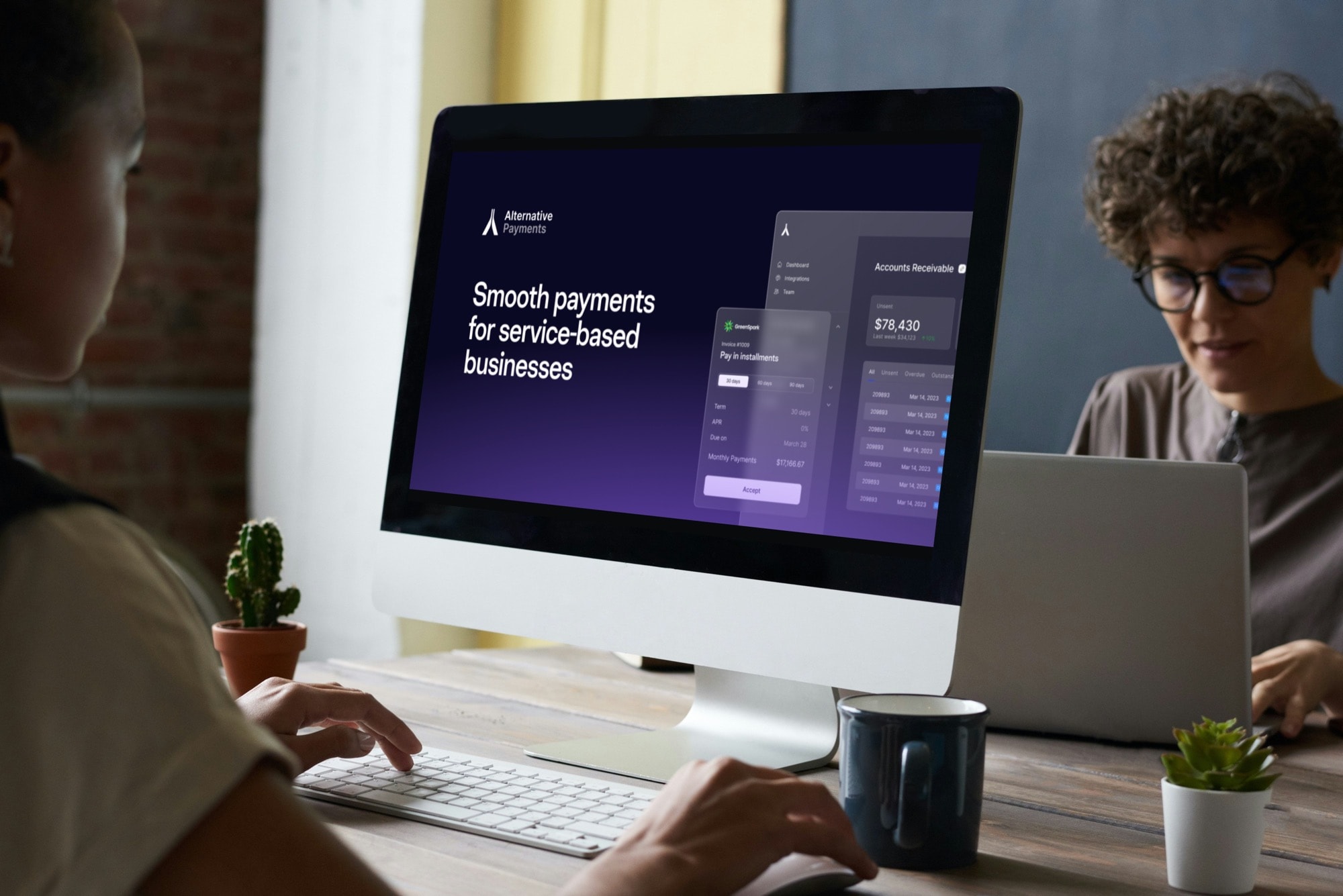

Learn more about how Alternative Payments can help you with your Accounts Receivable management practice today!