In the managed services provider (MSP) industry, maintaining healthy cash flow is crucial for sustainable operations. The accounts receivable process directly impacts your business’s financial health, affecting everything from day-to-day operations to long-term growth potential. While less than 10% of MSP clients are typically chronic late payers, even occasional delays in collecting payments can significantly impact business operations – especially considering MSPs must often pay vendor licenses regardless of client payment status.

Understanding Key Financial Metrics

Before implementing an accounts receivable strategy, it’s crucial to understand the financial metrics that reveal your MSP’s collection efficiency and overall financial health. These metrics help identify potential issues before they impact your ability to extend credit to clients or meet your own financial obligations. They also provide benchmarks for improvement and help quantify the success of your collection efforts.

Accounts Receivable Turnover Ratio

The accounts receivable turnover ratio is a critical efficiency metric that shows how effectively your MSP collects payment from clients who owe you money. This ratio reveals how many times per year your company collects its average accounts receivable balance.

Here’s how to calculate and interpret it:

Accounts Receivable Turnover Ratio Formula: Annual Net Credit Sales ÷ Average Accounts Receivable

Example Turnover Calculation: Annual net credit sales: $1,200,000 Average accounts receivable: $150,000 Turnover ratio: $1,200,000 ÷ $150,000 = 8

What This Means:

- A ratio of 8 means you collect your average accounts receivable balance 8 times per year

- To convert this to days, divide 365 by your turnover ratio (365 ÷ 8 = 45.6 days)

- This means it takes an average of 46 days for a customer to pay their invoice

- The higher the ratio, the more efficiently you’re collecting payments

- Lower ratios might indicate collection problems or the need to extend credit too liberally

Industry Benchmarks:

- Healthy MSP ratio: 8 or higher (45 days or fewer to collect)

- Concerning ratio: Below 6 (60+ days to collect)

- Poor ratio: Below 4 (90+ days to collect)

Average Accounts Receivable

Average accounts receivable helps you understand your typical outstanding balance and forms the foundation for other financial metrics. It’s essential for accurate cash flow forecasting and maintaining a healthy balance sheet.

Average Accounts Receivable Formula: Beginning AR + Ending AR ÷ 2

Example: January 1st receivables: $140,000 March 31st receivables: $160,000 Q1 average receivables: ($140,000 + $160,000) ÷ 2 = $150,000

Client Impact Analysis: Monitor clients’ payment patterns through aging reports that show:

- Current outstanding balance

- Historical payment trends

- Average days to pay

- Frequency of late payments

- Impact on overall AR average

When a client’s payment patterns consistently exceed your target AR turnover ratio (e.g., taking 60+ days when your target is 45 days), they’re negatively impacting your average. This can be tracked through:

- Accounts Receivable Aging Reports

- Client Payment History Reports

- Days Sales Outstanding (DSO) by Client

- Late Payment Frequency Reports

Red Flags to Watch:

- Client regularly exceeds payment terms by 15+ days

- Multiple invoices aging beyond 45 days

- Increasing balance with irregular payments

- Payment promises not met consistently

Cash Flow Impact

Understanding how accounts receivable affects your cash flow is crucial for MSP sustainability. Late payments and extended credit terms can create significant cash flow challenges.

Example Scenario: Monthly recurring revenue: $100,000 Average payment delay: 45 days Cash flow gap: $150,000 ($100,000 × 1.5 months)

Cash Flow Impact and Reserve Management

Understanding how accounts receivable affects your cash flow is crucial for MSP sustainability. Industry best practices recommend a layered approach to financial reserves and cash management.

Operating Reserve Requirements:

- Minimum Recommendation: 3-6 months of operating expenses

- Maximum Recommendation: Should not exceed two years’ worth of operating budget

- Primary Layer: 1-2 months of expenses in immediately accessible cash

- Secondary Layer: 4-5 months of expenses in low-risk, near-liquid investments

Strategic Reserve Management: Operating Expenses Coverage:

- Regular payroll commitments

- Infrastructure and licensing costs

- Vendor payment obligations

- Unexpected emergency expenses

- Seasonal fluctuation buffer

Credit Line Guidelines:

- Maintain minimum credit line of 50% of monthly revenue

- Establish credit lines before they’re needed

- Consider increases based on:

- Business growth trajectory

- Seasonal revenue patterns

- Planned major investments

- Industry-specific opportunities

Example Reserve Calculation for a Mid-sized MSP:

Monthly Operating Costs:

- Payroll: $50,000

- Infrastructure: $15,000

- Vendor Licenses: $10,000

- Operating Expenses: $5,000 Total Monthly: $80,000

Recommended Reserve Structure:

- Primary Layer (2 months): $160,000

- Secondary Layer (4 months): $320,000

- Credit Line: $50,000 (50% of monthly revenue) Total Protection: $530,000

Key Financial Considerations:

- Cash flow stability patterns

- Client payment terms and history

- Vendor payment obligations

- Seasonal revenue fluctuations

- Growth and capital expenditure plans

- Industry-specific risk factors

Best Practices for Reserve Management:

- Create clear reserve access policies

- Implement regular monitoring systems

- Establish replenishment protocols

- Maintain separate accounts for different reserve layers

- Review and adjust reserve levels quarterly

- Consider automated reserve management tools

Remember: Late payments from even a small percentage of clients can significantly impact these reserves, especially when MSPs must continue paying vendor licenses regardless of client payment status. Maintaining adequate reserves ensures business stability while providing flexibility for growth opportunities.

Setting the Foundation: Clear Payment Terms

The cornerstone of effective accounts receivable management lies in establishing clear, unambiguous payment terms from the start. This foundation determines how efficiently you can collect payments, minimize bad debt, and maintain positive cash flow. When you extend credit to clients through net payment terms, each element of your foundation must work together to ensure customers pay on time and protect your balance sheet from excessive late payments.

Each component of your accounts receivable foundation serves a specific purpose in maintaining healthy cash flow and client relationships. Here’s a detailed look at the essential elements:

Master Service Agreement (MSA)

Your MSA should clearly define:

- Billing frequency and timing

- Payment terms and due dates

- Late payment penalties and fees

- Service suspension triggers and timeline

- Contract termination conditions

- Collections process and responsibilities

- Early termination consequences and fees

Invoice Documentation

Ensure every invoice includes:

- Clear payment terms and due dates

- Available payment methods

- Late payment consequences

- Early payment incentives (if applicable)

- Direct payment links or portal access

- Contact information for billing questions

Payment Policies

Establish and document:

- Accepted payment methods

- Auto-payment requirements or options

- Credit card processing fees (if applicable)

- ACH/wire transfer instructions

- Payment application procedures

- Refund and credit policies

Communication Protocol

A well-defined communication protocol ensures consistent and professional interaction with clients regarding financial matters. This systematic approach helps prevent misunderstandings and provides clear documentation of all payment-related interactions.

Key Elements:

- Standardized timing and methods for all billing communications

- Clear escalation paths for overdue accounts

- Documentation requirements for payment interactions

- Response time expectations for client inquiries

- Service impact notification procedures

Summary:

- Establish consistent invoice delivery and reminder schedules

- Document all payment-related communications thoroughly

- Create clear escalation procedures for overdue accounts

- Set explicit service suspension warning protocols

- Define required response times for client payment issues

Financial Controls

Financial controls protect your MSP’s revenue stream and minimize bad debt risk by establishing clear procedures for extending credit and handling payment issues. These controls help maintain a healthy balance sheet while ensuring fair treatment of all clients.

Key Elements:

- Credit evaluation procedures for new and existing clients

- Risk management policies for payment terms

- Collections process guidelines

- Payment application and reconciliation procedures

- Bad debt prevention strategies

Summary:

- Implement thorough credit check procedures

- Establish clear security deposit requirements

- Set and maintain appropriate credit limits

- Create efficient dispute resolution processes

- Define strict collections handoff criteria

Implementing Preventive Measures

As Benjamin Franklin wisely noted, “An ounce of prevention is worth a pound of cure” – nowhere is this more true than in accounts receivable management. A robust preventive strategy helps ensure customers pay on time, reduces the risk of bad debt, and maintains consistent cash flow. By implementing the right preventive measures, you can significantly reduce the time and resources spent collecting payments and managing late payments.

The insights shared by MSP leaders like Raffi Jamgotchian of Triada Networks and Ann Westerheim of Ekaru emphasize that while chronic late payers typically represent less than 10% of an MSP’s client base, their impact can be severe. This is particularly true for MSPs operating on tighter margins, where paying vendor licenses regardless of client payment status can strain resources.

When clients consistently pay on time, your MSP can maintain healthier vendor relationships, invest in growth, and avoid the costly process of collections or writing off bad debt. Here’s how to build an effective preventive strategy:

Modern Payment Solutions

The easier you make it for clients to pay, the more likely they are to do so promptly. Modern payment solutions not only improve collection efficiency but also provide better tracking and reporting capabilities.

Key Benefits:

- Faster payment processing reduces days sales outstanding

- Automated systems minimize human error

- Digital trails improve accountability

- Real-time payment visibility enhances cash flow management

Implementation Checklist:

- Switch to electronic billing for faster processing

- Offer multiple payment methods to accommodate client preferences

- Set up automated payment reminders to maintain consistent communication

- Include payment links in all billing-related communications

- Consider requiring auto-pay options for recurring services

- Implement early payment discount programs

- Provide real-time payment portal access

The Communication Timeline: A Strategic Approach

Pre-Invoice Phase

Proactive communication before invoicing can prevent many payment issues:

- Send advance billing updates for upcoming charges

- Provide real-time billing visibility through client portals

- Address potential discrepancies before they become problems

Invoice Period Best Practices

When sending invoices:

- Provide immediate invoice notification

- Include clear, actionable payment instructions

- Embed relevant payment links

- Follow up to confirm receipt of invoice

Strategic Payment Reminder Schedule

Implement this systematic reminder approach:

- 5 days before due date: Send a friendly reminder

- 1 day before: Issue a due date reminder

- Due date: Send final reminder

- 1 day past due: Initial late notice

- 5 days past due: Follow-up communication

- 15 days past due: Escalated reminder

- 30 days past due: Final warning before collections

Handling Difficult Conversations

When payment issues arise, phone conversations often become necessary. Follow these best practices:

Professional Communication Guidelines

- Schedule calls during regular business hours

- Maintain a consistently professional tone

- Document all conversations thoroughly

- Focus on finding solutions rather than placing blame

- Discuss how payment issues impact the service relationship

- Be prepared to offer payment plan options when appropriate

When to Consider Collections

The decision to send an account to collections represents a critical juncture in the client relationship. While collections can help recover outstanding payments, it also typically marks the end of the business relationship and may only recover a portion of the amount owed. This step should be taken only after exhausting all other options and carefully documenting all attempts to resolve the payment issue.

Consider collections when multiple factors align:

- Invoices remain unpaid beyond 30 days despite multiple communication attempts

- Client has been unresponsive or unwilling to establish a payment plan

- Service has been suspended according to MSA terms

- All internal collection efforts have been documented and exhausted

- The outstanding balance justifies collection costs

- Client relationship has deteriorated beyond repair

Documentation Requirements

Before initiating collections, maintaining comprehensive documentation is crucial not only for the collections process but also for potential legal action. This documentation serves as your evidence of services rendered and collection attempts, while protecting your business interests throughout the process.

Required documentation includes:

- Complete client contact information and contract details

- Detailed invoice history and payment records

- Chronological logs of all payment-related communications

- Signed service agreements and change orders

- Proof of services delivered (time logs, tickets, reports)

- Records of any payment promises or arrangements made

- Documentation of service impacts or suspensions

Collections Process and Negotiations

During the collections process, be prepared for various outcomes:

- Clients may negotiate for reduced payment amounts

- Payment plans might be proposed to avoid collections

- Legal action may be necessary as a last resort

- You may need to consider writing off some amount as bad debt

Best practices for collections negotiations:

- Consider reasonable settlement offers to avoid legal costs

- Document all negotiation attempts and offers

- Keep detailed records of any partial payments

- Maintain professional communication throughout

- Consider third-party mediation before legal action

Maintaining Client Relationships

The relationship between an MSP and its clients extends far beyond simple transaction processing. As demonstrated by Triada Networks’ experience, payment issues sometimes reveal opportunities to help clients improve their internal processes, potentially strengthening the relationship. While maintaining strict payment policies is crucial, how you handle payment issues can either strengthen or damage valuable client relationships that may have taken years to build.

Strong client relationships contribute directly to your MSP’s financial health through:

- Reduced customer churn

- More reliable payment patterns

- Higher likelihood of service expansion

- Positive referrals and references

- Easier resolution of payment issues when they arise

Relationship Preservation Strategies

- Keep all communications professional and documented

- Offer flexible payment solutions when possible

- Consider the client’s payment history before escalation

- Maintain service quality during resolution

- Look for win-win solutions that preserve the relationship

Long-term Preventive Strategies

To minimize future payment issues and optimize your accounts receivable process:

- Implement robust automated billing systems

- Consider offering early payment incentives

- Conduct regular financial reviews with clients

- Establish clear escalation procedures

- Provide multiple payment options to suit client preferences

- Regularly review and optimize your accounts receivable turnover ratio

- Monitor average days sales outstanding (DSO)

- Implement cash flow forecasting tools

Outsourcing Collections with Alternative’s Collections Assist Service

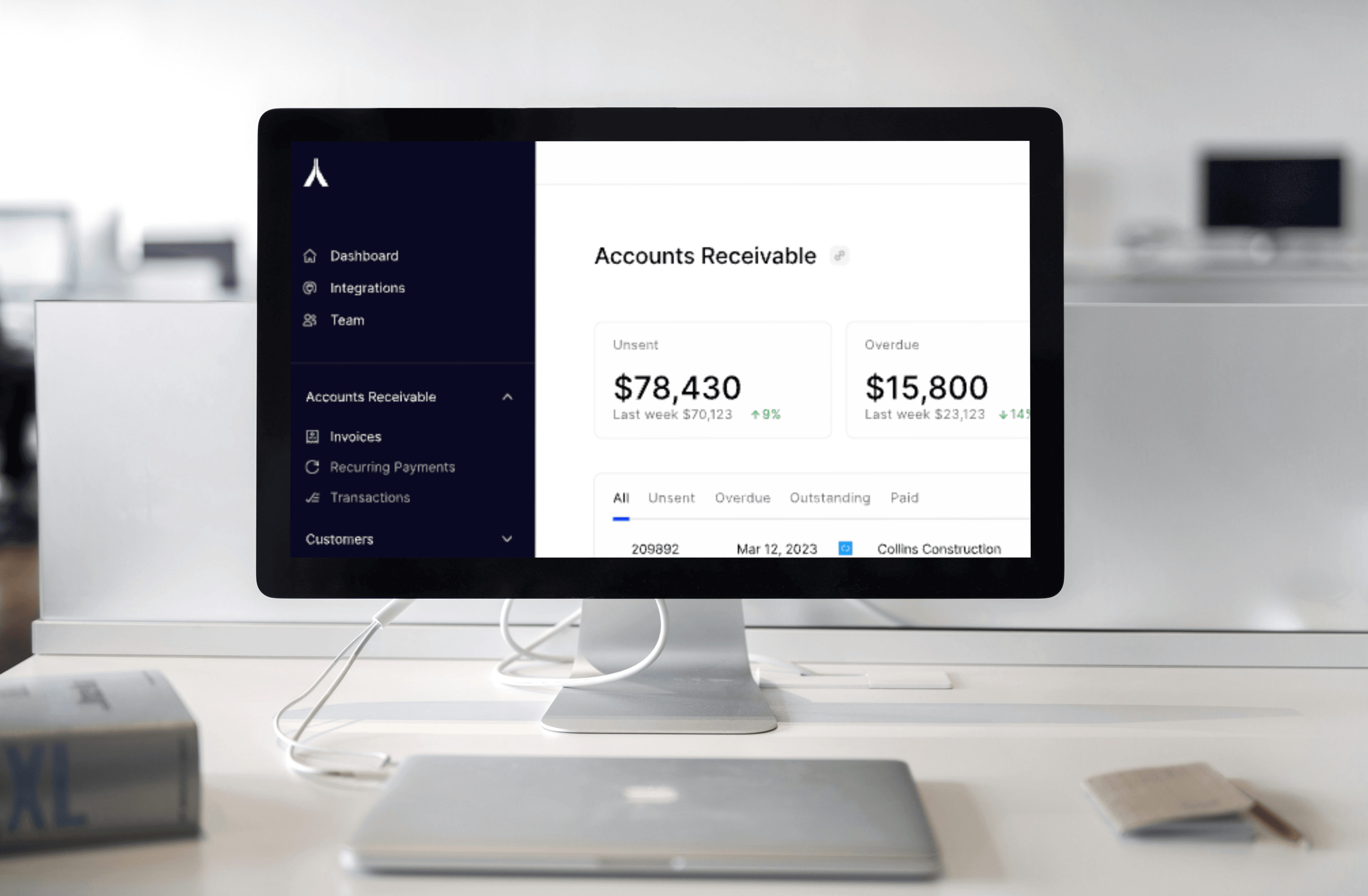

For MSPs looking to further optimize their accounts receivable process and avoid the time-consuming collections process, Alternative Payments offers our Collections Assist service. This service allows you to outsource the collection of invoices that have remained uncollectable despite your best efforts.

Benefits of Collections Assist:

- Free up your team’s time to focus on core business operations

- Leverage Alternative’s expertise in collections for better results

- Maintain professional, well-documented collections communications

- Increase recovery of outstanding balances

- Preserve client relationships by having a third-party handle collections

How Collections Assist Works:

- After exhausting your internal collections process, identify invoices to refer to Collections Assist

- Provide Alternative with required documentation of unpaid invoices and collections efforts

- Alternative’s collections specialists take over communication with clients

- We work to recover as much of the outstanding balance as possible

- Recovered funds, less a collections fee, are transferred to your account

- You receive a detailed report of collections efforts and results

By leveraging Collections Assist for your most difficult collections cases, you gain a partner to share the burden of the collections process. Our team works as an extension of yours, aiming to recover funds while preserving client relationships wherever possible.

Considerations for Using Collections Assist:

- Ensure all internal collection procedures have been thoroughly attempted and documented

- Provide Alternative with complete records to facilitate the collections process

- Keep Alternative informed of any client communications that may impact collections

- Consider Collections Assist as a last step before writing off receivables as bad debt

Integrating Collections Assist into your overall accounts receivable strategy provides a valuable safeguard for your MSP. It allows you to focus your resources on proactive strategies to avoid payment issues, while knowing you have expert support for recovering funds if internal efforts fail. By combining robust in-house procedures with the Collections Assist safety net, you create a comprehensive approach to optimizing your cash flow and minimizing bad debt.

To learn more about Collections Assist and whether it’s right for your MSP, contact our accounts receivable experts today. We’ll work with you to understand your current collections process and challenges, and develop a customized solution to meet your needs.

Conclusion

A proactive accounts receivable strategy is essential for MSP success. By implementing these comprehensive approaches to payment management and focusing on key financial metrics, you can maintain healthy cash flow while preserving valuable client relationships. Remember that consistency in following these procedures is key to their effectiveness.

The most successful MSPs view accounts receivable management not as a confrontational process, but as an integral part of client relationship management. By setting clear expectations, maintaining professional communication, and having systematic procedures in place for collecting payments, you can minimize payment issues while maximizing client satisfaction and retention.