Staying ahead of trends and technological advancements is crucial for maintaining a competitive edge in any business. AR automation software or effective accounts receivable management practices are not likely what immediately comes to mind when considering new growth strategies; nonetheless, differentiated alpha is always something that strategic-minded leaders want to uncover.

AR automation can no longer be ignored or considered an afterthought. Like any leader looking for market share capture, it’s time to be curious and consider how and why AR automation software is emerging as a game-changer in driving efficient growth. Larger companies have generally become early adopters; however, their experience and satisfaction with accounts receivable software is more nuanced than it appears at first glance. Even for enterprise solutions, it is evident that many payment processing solutions branded as AR automation are excessively complex, resulting in diminishing returns on productivity.

Despite being subtle, the benefits are clear: improved cash flows and the ability to achieve the operational efficiency companies strive for. Therefore, before jumping into the deep end blindly, it’s important to understand the difference that the right partner, and not just any solution, can make.

The Future of AR Automation Software in MSPs

In any economic climate, it’s essential to remain open-minded and proactive. Market volatility should not be a mandate or essential precursor for your organization to explore new concepts and technologies that can accelerate growth. AR automation software presents an opportunity for MSPs to optimize their accounts receivable processes, streamline operations, and drive sustainable growth.

Every company should be looking at automation. Quicker cash conversion cycle allows you to grow fast without having to go outside for money.

Embracing Digital Technologies

Payment portals, chargeback management, and collections are areas where smaller companies can leverage digital technologies to enhance their AR processes. By embracing AR automation software and innovative payment solutions, businesses can streamline operations, reduce costs, and improve customer satisfaction.

Evaluating Opportunities for Growth

As a leader, it’s important to assess whether there are any unique processes or technologies that have previously been overlooked but could potentially accelerate your business’s growth. Remaining open-minded and receptive to change is key to seizing new opportunities and staying ahead of the competition.

Understanding the Competitive Landscape

Understanding your competitive landscape and how your competitors are processing payments can provide valuable insights into areas for improvement and innovation. By proactively exploring modern business operations and embracing new technologies like AR automation software, MSPs can position themselves for success in the market.

The Transformative Power of AR Automation Software

The future of AR management is here, and AR automation software is at the forefront of this transformation. While adoption rates are still relatively low, particularly among small firms, the benefits of AR automation are undeniable.

Enhancing Efficiency and Accuracy

AR automation software streamlines invoicing, payment processing, and collections, resulting in enhanced efficiency, speed, and accuracy in payment handling. Companies that have adopted AR automation report higher satisfaction levels and fewer invoicing errors, highlighting the transformative impact of this technology.

Driving Cash Flow Optimization

AR automation software can significantly reduce days sales outstanding (DSO), leading to improved cash flow management and financial stability. Despite the clear advantages, many small firms have yet to fully embrace AR automation, presenting an opportunity for forward-thinking MSPs to gain a competitive advantage.

From a cash flow management point-of-view, there is a compelling link between AR automation and significantly reduced days sales outstanding (DSO). AR automation can reduce DSOs by as much as 32%, with the average DSO being 19 days. This data is a wake-up call for smaller businesses lagging in AR automation adoption. With larger competitors already harnessing the technology, smaller enterprises must explore how they can integrate AR automation to remain competitive.

Innovating the AR Landscape

We have observed how the AR function can improve processing speed. However, it’s not just about speed; accuracy also plays a crucial role in quickly applying cash to accounts and reducing time-to-value. This is beneficial for both customers and staff. CFOs especially appreciate the visibility that AR automation solutions like Alternative Payments provide to the accounts receivable function — instilling greater confidence in forecasting.

Sixty percent of CFOs at highly automated firms attributed improved processing speeds and real-time updates to a reduction in their company’s DSO. At the same time, 40% said automating tedious, labor-intensive tasks dropped their DSO. CFOs also noted significantly fewer errors in their AR processes.

The Advantages by the Numbers

The adoption of AR automation is still in its infancy, but the advantages are clear:

- 27% of small firms have automated more than half of their AR processes

- 93% of companies that automated at least 50% of AR processes expressed satisfaction

- 63% of firms with highly automated AR processes experienced fewer invoicing errors

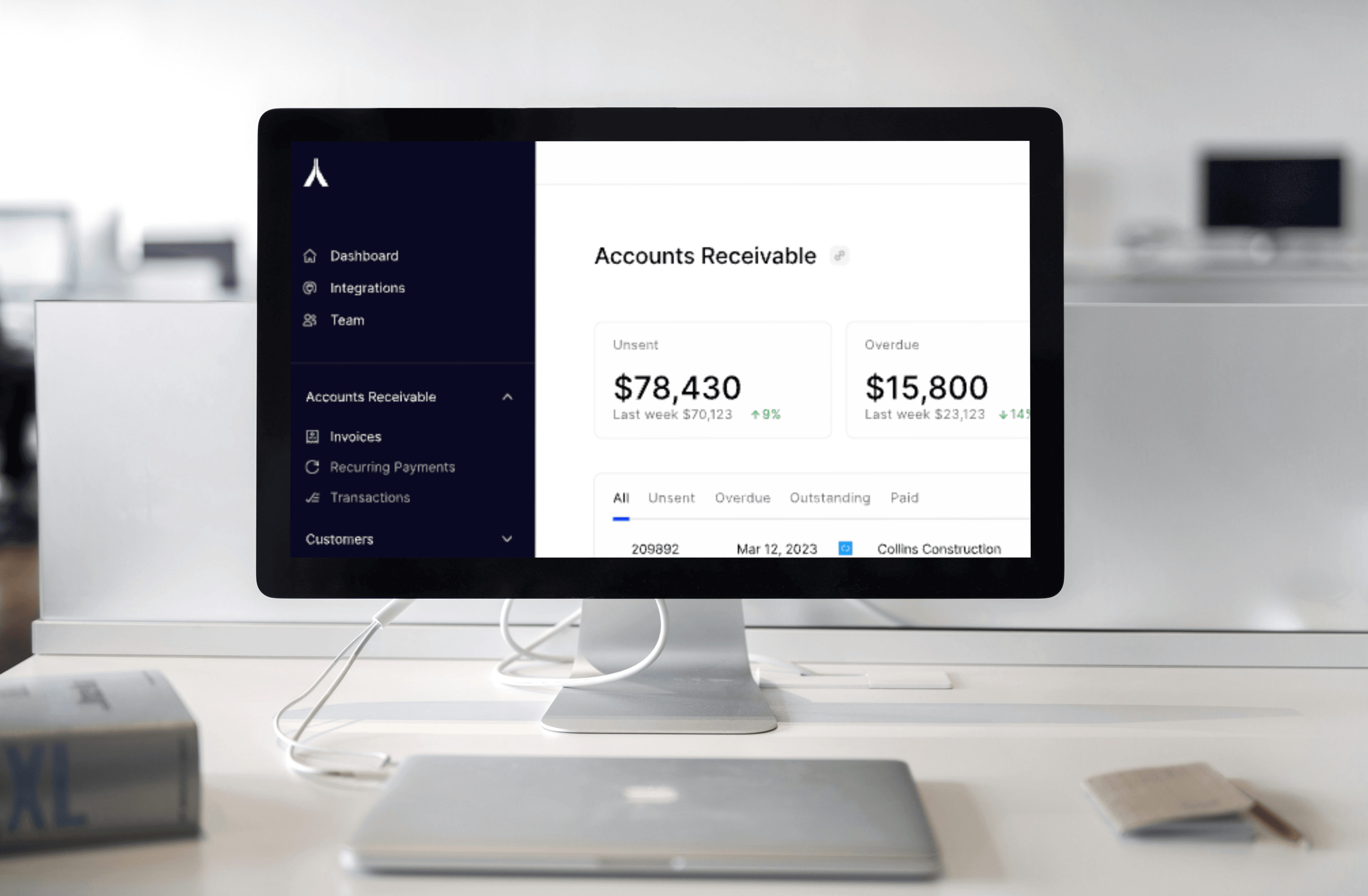

Innovative solutions like Alternative Payments are revolutionizing the AR landscape by providing seamless, streamlined processes tailored to the needs of businesses, including smaller enterprises. With features designed to reduce DSO and improve cash flow, Alternative Payments offers a unique solution for businesses looking to optimize their accounts receivable processes.

Speaking of DSO, if you haven’t seen our 2024 B2B Payments Trends Report, using our proprietary data we saw a 50% reduction to an average 6.2 days-sales-outstanding (representative of a $10M revenue business) and experiencing a resulting $600k improvement in cash flow.

Understanding AR Automation: Streamlining Receivables Management

At its core, AR automation involves leveraging technology to streamline the invoicing, payment, and reconciliation processes associated with accounts receivable. Through the use of advanced software solutions and algorithms, manual tasks such as invoice generation, payment reminders, and cash application are automated, reducing the burden on MSPs’ administrative resources.

Key Components of AR Automation:

- Invoice Generation & Distribution: Automating the creation and delivery of invoices to clients.

- Payment Reminders: Sending automated reminders to clients for outstanding invoices.

- Cash Application: Automatically reconciling incoming payments with outstanding invoices.

- Reporting & Analytics: Providing insights into AR performance and trends for informed decision-making.

The Benefits of AR Automation Software for MSPs

The adoption of AR automation offers a myriad of benefits for MSPs looking to streamline operations and drive efficiency:

1. Increased Efficiency

By automating repetitive tasks, MSPs can significantly reduce the time and resources required for AR management, allowing staff to focus on higher-value activities. This can result in improved customer satisfaction, increased productivity, and cost savings. Automation helps reduce the risk of human error and consequently increases the accuracy of receivables management.

2. Data-Driven Insights

AR automation platforms offer robust reporting and analytics capabilities, providing MSPs with valuable insights into their AR performance and areas for improvement. It would be worthwhile exploring a macro digital transformation initiative across your organization, which in itself would help with your data hygiene and accuracy.

3. Improved Cash Flow

Accelerated invoicing and payment processes lead to faster cash collection, improving cash flow and liquidity for the MSP. Consider the impact of implementing a data-driven approach and a digitally modernized tech stack. This drives operational excellence in areas such as attribution, prescriptive analytics, and forecasting to optimize budgeting and set realistic expectations.

4. Enhanced Customer Experience

Generate and send invoices to customers for goods or services provided. With automated payment reminders and streamlined processes, MSPs can provide a seamless and hassle-free experience for their clients, fostering stronger relationships and loyalty.

Implementing AR Automation Software: Best Practices for Success

While the benefits of AR automation are clear, successful implementation requires careful planning and execution:

1. Assess Your Current Processes

Conduct a thorough assessment of your existing AR processes to identify pain points and areas for improvement. Analyze how your current processes are impacting customer service and satisfaction. Identify opportunities for streamlining and automation.

2. Choose the Right Solution

Select an AR automation platform that aligns with your business needs, scalability requirements, and integration capabilities. Define goals and set a timeline for implementation. Develop an action plan and begin implementation.

3. Train Your Team

Provide comprehensive training and support to your staff to ensure they are equipped to utilize the new automation tools effectively. Celebrate successes and share best practices. Provide feedback to employees to maintain motivation and engagement.

4. Monitor and Iterate

Continuously monitor the performance of your AR automation system and iterate as needed to optimize efficiency and effectiveness. Evaluate the return on investment of new AR processes. Continue to innovate and improve automation processes.

Embracing the Future of AR Management

The key is to work with a company that does exactly what you need in a turnkey manner. It is clear that the potency of AR automation is dependent on the breadth of application across a firm’s accounting processes, and there is a strong positive correlation to those that apply more AR automation seeing a more substantial impact.

To capitalize on the potential of AR automation while mitigating its challenges, CFOs must navigate the transition away from manual AR processes with a focus on ease of use and reliability, striking a balance that will enable firms to fully leverage the critical benefits of automating previously labor-intensive, error-prone human AR functions.

Accounts Receivable Automation for MSPs

AR automation represents a significant opportunity for MSPs to revolutionize their operations and drive sustainable growth. By streamlining processes, improving cash flow, and enhancing the customer experience, MSPs can position themselves for long-term success in an increasingly competitive market landscape.

Using Alternative Payments, MSPs can overcome common challenges with simplicity and efficiency. Alternative Payments is an Accounts Receivable Automation partner that is committed to your success.