Podcast Transcript:

Nathan: Just to be clear, you haven’t deployed 10 million yet. So, you’re under a $1.2 million run rate, but you think you can break that fairly quickly if you deploy the capital.

Baxter: Yeah, we should be able to hit that pretty quickly.

[Music playing]

Nathan: You are listening to conversations with Nathan Latka, where I sit down and interview the top SaaS founders, like Eric Yuan from Zoom. If you’d like to subscribe, go to getlatka.com. We’ve published 1000s of these interviews, and if you want to sort through them quickly by revenue, or churn, CAC, valuation, or other metrics, the easiest way to do that is to go to getlatka.com and use our filtering tool. It’s like a big Excel sheet for all of these podcast interviews. Check it out right now at getlatka.com.

Hey, folks, my guest today is Baxter Lanius. He’s a CEO and founder of Alternative. Alternative drives revenue growth for SaaS companies by offering flexible b2b payment solutions for end customers and arming sales teams with an additional tool to convert customers. Previously, he was a FinTech technology investor at Apollo Global and Victory Park Capital.

Baxter: Thanks for having me, Nathan.

Nathan: All right. I mean, as you know, Fintech is like hot, hot, hot right now. So, did you sort of see these valuations, multiples, at Apollo and Victory and say, “I need to ditch the investor thing and jump into an operator role?”

Baxter: A little bit. It’s an interesting story. I’ve been following FinTech over the last 12 years or so. I really started investing in FinTech in 2014 and saw the boom of the industry. At the time, I was pretty unimpressed with the platforms that were founded in that timeline, because ultimately, many of them were just customer acquisition moats and strategies around websites and podcasts and news, etc. And there were not really many companies that were actually innovating in this space. So, I decided to leave Victory Park actually, and start investing in technology companies at Apollo. And then I saw this whole kind of wave of FinTech 2.0, as I’ll call it, where there’s just a tremendous amount of innovation and opportunity in this space to really disrupt the number of banks that are currently the incumbents. And we just started to really focus on b2b payments and b2b payment solutions to ultimately innovate the very antiquated process that is b2b invoicing and payment flows. And so, this is our first foray into the space and first product launch, which we’re launching more broadly in the next week or two. And it’s been a really, really exciting journey. And I think there’s just so much innovation available and still untapped.

Nathan: So, tell me more. I mean, when people look at your website, and they don’t have a deep understanding of FinTech, they might go, “Wait, this is an invoicing tool. FreshBooks sort of is great here. There’s a lot of invoicing tools. How are these guys different?”

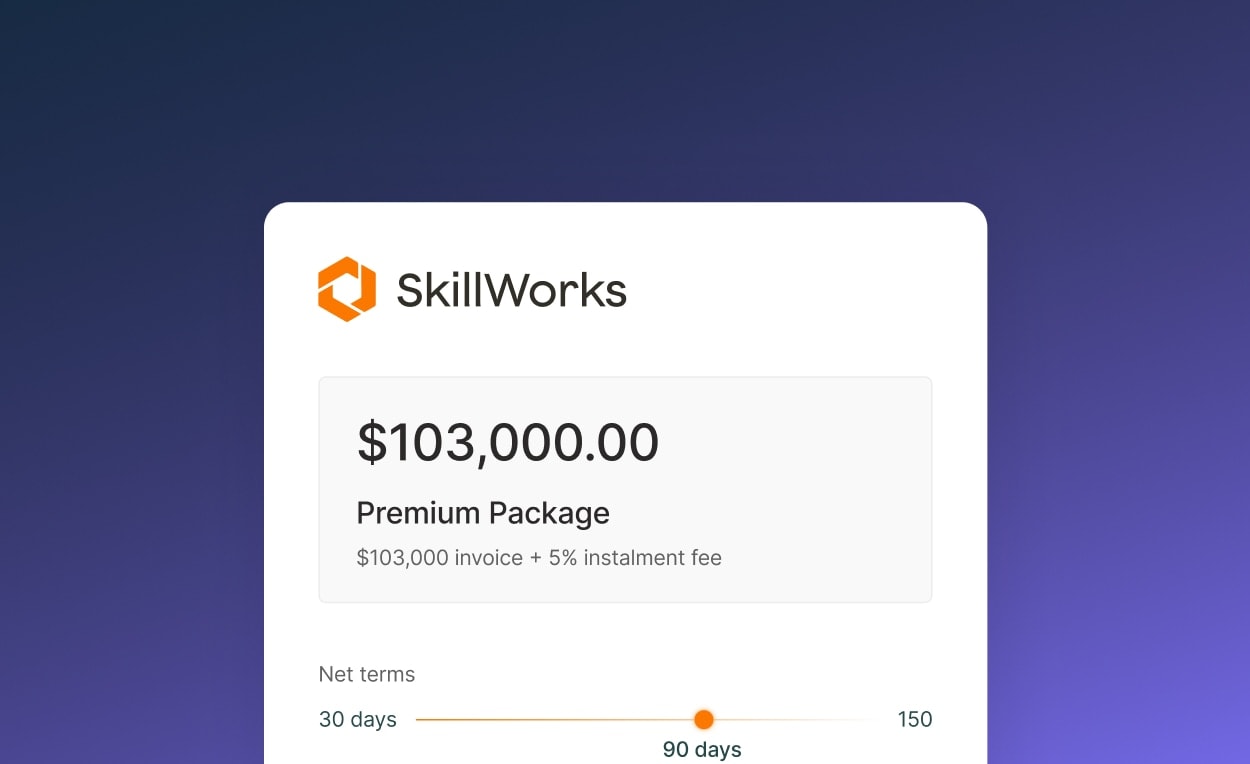

Baxter: Yeah, so we see our product as really a sales enablement tool to ultimately unlock customer acquisition, drive and deliver flexible payment solutions to your end customers to drive revenue growth by increasing average contract values and decreasing the sales cycle. So, it’s funny, you bring this up. I received a bill the other day for $10.50 from a publicly traded software company. They said, pay by wire. I said, “$10.50? You’d like me to pay by wire? That’s going to cost me $20 to send the wire and they had no other payment solutions.” Now, that’s just the tip of the iceberg in this market when you then look at, $5,000 invoice or a $10,000 invoice, there are really only two solutions. Pay by ACH, pay by wire. And ultimately what we’re doing is, we’re arming sales teams, arming collections teams, arming revenue ops teams to have another flexible payment solution to allow them to pay over time. Now, what does this create and what does this do?

It expands a whole new market for a lot of these companies. If you’re Salesforce and you’re interested in getting into the SMB space, a lot of people can’t afford $80,000 upfront. And ultimately, we offer pay overtime solutions that are fully customizable for that specific customer. And it’s just a really interesting, interesting solution that doesn’t exist today. And we’ve had just an enormous amount of growth on the customer side to generate and deliver revenue for our customers.

Nathan: The equivalent in the consumer space would be, I’m buying a mattress for $4000 bucks. I use the little Affirm button to pay monthly over time. That’s sort of the equivalent here, right?

Baxter: That’s exactly right. Affirm, Klarna, Afterpay are the leaders in the consumer space. One of the key differences in the b2b space is, Affirm, Klarna and Afterpay use an iframe and kind of take over that checkout experience. We view our tool as strictly complimentary to the existing workflows of the business. So, we can actually get you onboarded and integrated within minutes as opposed to taking engineering hours to integrate in a long sales cycle. So, we can have you get started, finance your customers in minutes, and we view it really as a complementary tool to expand TAM, expand market share and close customers a lot quicker than you historically were able to. When you think about pricing negotiations as well as part of the sales cycle, it is a significant portion of the sales cycle. And if you can limit that by 50% or 20% by allowing customers to pay overtime, it’s also an amazing value add.

Nathan: So, let’s use an example here. Let’s stick with your Salesforce example. Okay, I’m an SMB. I really want to use Salesforce, but I’m not paying – you know, I can’t and let’s say my quote from Salesforce is $10,000, right? For one seat annually. SMB can’t pay that. So, I’m going to stop engaging with the Salesforce sales rep. What you’re saying is that Salesforce sales rep could offer the purchaser, right, an SMB, the payment plan for that $10,000. Now, what might that payment plan look like?

Baxter: That’s exactly right, Nathan. And so, the easiest way to think about it is our existing generic plan is six months of payment terms. So, you would break that $10,000 contract in the six payments of about $1,600. And we would front the capital to Salesforce on day one. So, Salesforce is ultimately able to basically close that contract on day two. So, there’s no not even net 30 days payables for Salesforce. They receive 95% of 10,000. So, we each take a 5% fee. So, we’d wire them $9,500 upon closing, and then we’d collect from the customer $1,600 over six months. And that allows that small business to ultimately start to generate an ROI on the Salesforce CRM solution and start to expand their business. So, now they can afford that solution, they can drive revenue growth at the same time.

Another interesting example that you see all the time is even with really, really large companies, if you look at their software spend – a lot of it’s concentrated in January, February, or specific months. And so, their P&L and their budget is, you know, call it negative a million and a half and then zero for software spend. They want to attach an ROI to that dollar spend and so that their P&Ls and their budgets are properly balanced, and they’re able to generate revenue based off of that spend.

Nathan: So, just to be clear. I’m Salesforce, I’m using you guys. I close a $10,000 contract that I wouldn’t have closed without you. Because it’s a new solution for the SMB to actually be able to pay. As Salesforce, I’m gonna get a $9,500 check from you on day one. Alternative pays that. Then, you’re gonna make – is the SMB paying you directly?

Baxter: The SMB is paying us directly.

Nathan: Okay, so $1600 for six months, right? Or about $9,600, right? You fronted $9,500 to Salesforce on Day One. Right? So, there’s two things where I’m curious where this money goes. The $100 extra that the customer pays above $9500, where does that go? And then where does that $500 go originally that you sort of discount on the contract?

Baxter: Yeah, so we would think about it. So, we collect $500, right, which is 5% of the 10,000. And so, the customer is paying us, you know, in over the course of six months, 1600, you know, it’s just over $1,600. So, we ultimately earn $500 in that transaction. What we’re seeing a lot –

Nathan: But do you make the other $100 though from the customer, because they’re paying you $9600 against a $9,500 advance, so you’re making another $100 from the end customer, right, the SMB?

Baxter: So, we’re making $500 from the SMB.

Nathan: Sorry, I thought that was for Salesforce because you are only wiring Salesforce, $9500 bucks, right?

Baxter: We wire $9,500 to Salesforce; we then collect $10,000 from the end customer.

Nathan: Oh, sorry, how do you get to $10,000? $1600 times six months is only $9600 bucks.

Baxter: It’s $1,666.67.

Nathan: Okay, got it. So, you are collecting the full. That’s what I am trying to figure out.

Baxter: Exactly.

Nathan: You’re rounding. There’s no margin built in here. You’re collecting the full $10K from the customer?

Baxter: Exactly. And what we’re seeing is Salesforce now has the ability to just pass through that pay overtime solution to their customers. So, Salesforce now has pay up front at $10,000 or pay overtime at $10,500. This way at a net-net perspective, Salesforce is still breaking even on the transaction, but they’re able to now finance their customers.

Nathan: Okay. So, the question here is, how do you write that $9,500 check to Salesforce on day one, what’s your capital source?

Baxter: So, we’re funded with debt and equity. We’ve raised just under $15 million, a portion of that is in a credit facility, and so we fund that transaction through our credit facility.

Nathan: Okay, so just to be clear, you’ve raised $15 million together that is the debt and the equity?

Baxter: Exactly.

Nathan: Okay. And what? $5 million was equity, something like that?

Baxter: Exactly. It was five.

Nathan: And $10 million is the total committed amount on the warehouse facility or that’s how much you’ve already deployed?

Baxter: That’s how much is drawn.

Nathan: Oh, you’ve already drawn $10 million. So you’ve already –

Baxter: It’s in the bank. It’s a little bit of a different credit facility than your normal course FinTech credit facility. So, we have available capital of $10 million, which is currently in the bank. And we draw down that as we see demand for our product. And so, we will be going through that pretty quickly here in the next handful of months.

Nathan: I was gonna say, so you think you can do $10 million worth of deals over the next couple of months?

Baxter: Probably more.

Nathan: Probably more. Okay. That’s great. What did you do last month, you know?

Baxter: I’d rather not disclose because we’ve been in kind of this private beta period with a handful of customers and now, we’re alone. We’ve started our go to market strategy over the last four weeks, and now we’re launching more publicly.

Nathan: Okay, well, I’m gonna guess here. Do you think you can break a million dollars in new deals like new loans this month in April?

Baxter: Yes. Yes. Yes.

Nathan: Yeah. Yeah. Cool. Okay, there you go. There you guys have it, guys. Now you have a little benchmark there. Right. So, okay, this makes sense. Now, the reason most credit facilities or warehouses or FinTech entrepreneurs don’t draw down that 10 million is because they’re paying unused, like you’re paying an interest rate no matter what, whether it’s deployed or not. You just have a lot of competition … to deploy quickly. So, you’re okay paying your warehouse provider, whatever their interest rate is.

Baxter: And we ultimately don’t have unused fees on our credit facility. So, we have basically a flat rate associated with deployed capital. There are no upfront unused fees and incremental spend, which I think you see in most obviously, typical and traditional facilities, especially facilities that I used to invest in. So, we have a little bit of a different structure and setup that I would say is preferential to both our end customers and preferential to the business. Ultimately, we pass through a lot of these opportunities to our end customers to ultimately give them better rates on these underlying transactions.

Nathan: Do you guys care about valuation right now, specifically, your valuation? Do you think you might raise soon or sell a portion of the company. There is no other tool on the internet that you can use to get a better and higher valuation than Founderpath’s new valuation tool. We have over 253 deals that went down over the past 30 days. All the revenue numbers, all the valuations and the multiplier. That way, you can go filter the data, find companies that are your same size, what they sold or raised for or at, and then use those as comparables in your decks to argue and debate and get a higher valuation and less dilution, which is the name of the game, less dilution. Check it out today at founderpath.com/products/valuations, again, both plural, founderpath.com/products/valuations.

So, you might have an advantage because of your connections in the industry with Apollo and Victory Park, but most FinTech entrepreneurs, first timers, when they’re raising their first credit facility like this, they’re gonna pay something between a 10% and 13% interest rate on capital that’s deployed, right, their cost of capital, and also there’s probably like warrants and some covenants and things like that in that term sheet. Is your cost of capital sort of in that same range? 10% to 13%?

Baxter: It’s just below that. But that’s exactly right. I mean, I wouldn’t actually provide the market. I mean, it’s more like 10% to 18%. Typically, advance rates are 80% and 90%, depending on your credit underwriting ability, and there’s also a credit box associated with all these transaction rates.

Nathan: What was your advance rate? You got 90%?

Baxter: Our advance rate is actually at 80% for a number of strategic reasons. But yeah, we had the ability to go up to 90% if we –

Nathan: Wait! Hold on! I don’t understand. Most entrepreneurs are going, we want the highest advance rate possible there as we have to come up with $0.20 on every dollar, but you’re saying, strategically, you want to keep it low. I don’t believe you. Why do you want to keep that low?

Baxter: We’re not providing all of the equity haircut capital. So, within that 20%, we have an additional capital provider that splits that amount. So, if you are using round numbers, our facility called it as $10 million, $8 million would be the senior tranche, $2 million would be the junior tranche. We’re not contributing the entire $2 million tranche. I also think that within any of these platforms, you also do want to de-risk your underlying asset quality and underwriting and ability to do due diligence on these deals and so taking out as much leverage as what’s available to you is not always the best strategy.

Nathan: Okay, come on, Baxter, who’s the third party you stuck in here? They must be like very strategic? Is it Apollo or Victory? They’re not gonna do a $2 million tranche deal, right?

Baxter: No, it’s very small institutions that we have a very strong relationship with.

Nathan: Interesting, okay. Is your own money in that? Are you an LP in that institution? Are you deploying your own personal capital through that tranche?

Baxter: My own personal capital is also in the junior tranche, not through the company.

Nathan: That is how you build a great company here, right and get like the best of both worlds on all sides. This makes total sense. Okay, let’s go back to talking about market and understand economics. I mean, how do you go convince like, right, Salesforce and all these guys just sort of adopt you? What’s that playbook look like?

Baxter: The playbook actually is quite simple and it’s all about revenue growth, right? I mean, we’re charging 5%, which to some companies, I mean, the way we think about it is, it’s really 2% above what credit card fees are. So, if you’re using Stripe for your payables, we’re charging 2% incremental to Stripe on collections. And it’s really all about revenue growth and the ability to cross sell, upsell, and drive price increases. So, within our existing beta customer group, we’ve seen ACVs rise by about 25%. And we’ve seen a sales cycle decline by about 15% driving just under 50%, revenue growth. And so, the opportunity is really in that in a nutshell, is how do you upsell, cross sell, drive price increases? And then how do you pivot from a monthly subscription strategy and plan to really upfront contracted revenue. So, we also have a number of businesses who, you know, to get started into the market, started with a monthly subscription plan because it’s a little bit more amenable from the customer side. And now we’re getting those customers to pivot to upfront contracted pricing, using our pay overtime flexible financing solutions as the incentive to the end customer.

Nathan: And Baxter, how many of the end customers do you have right now? How many companies you use factor at least one invoice?

Baxter: So, we have just over 10.

Nathan: Okay, just over 10? And are these all b2b SaaS companies, mainly?

Baxter: B2b SaaS and services businesses.

Nathan: And service. Okay, last question here. Obviously, vintages, default rates, borrowing base certificates, right? You’ve got to try and underwrite that SMB and their ability to repay that 1666 per month. How do you handle that?

Baxter: So, we’re integrated on a number of different platforms. The first integration that we use is a pilot API. So, we do a quick kind of bank account underwriting model. We underwrite them pretty quickly based off their cash balance, based off their cash burn, and their ability to repay. We also look at a number of different alternative datasets regarding software review data, investor data, etc to ultimately get up to speed as quickly as possible on the borrower. And make sure that that diligence process and that underwriting process is actually super streamlined.

Nathan: But Baxter, that Salesforce sales rep though now has to ask that SMB to connect their bank account. They might argue that’s really high friction, how do you get around that?

Baxter: Onboarding takes less than a minute. And we can approve the invoice within an hour. So we will not bill for that.

Nathan: Well, it’s not that type of speed. It’s the confidentiality. It’s the, oh my God, I have to give all my bank information to this middle party I don’t know about just to do a Salesforce contract?

Baxter: Yeah, it’s a great question. I think that a lot of people are much more interested in ultimately being able to finance these transactions and be able to pay these transactions to ultimately deliver and generate an ROI attached to that dollar. And people have continued to push and been okay with sharing some of this information to get access to the capital that they need to grow. And if you think about what stripe has access to, what any of these platforms have access to, I think we’re a lot more amenable to sharing and that will continue – that trend will continue for years to come.

Nathan: And Baxter, so what do you – when you put your performance together right on the fund structure? Right, I think you said your blended cost of capital including the junior tranches are just under 10%. Right, that’s blended?

Baxter: No, the senior is just under 10%. Blended is, to your point, 10 …

Nathan: Okay, cool. So, the junior is making a little bit more. So, there’s more risk, they are subordinated under the main tranche?

Baxter: Exactly.

Nathan: What do you think you can earn on the fund? What do you think what’s the projected IRR?

Baxter: So, we’ll be able to earn probably mid-20s. And so, our spread on our business is, call it in the conservative manner about 10%.

Nathan: So how do you do that? People are gonna hear, you charge 5%. But then they’re gonna go, Wait, how does he earn 25% IRR? How does that work?

Baxter: So, the goal is in terms of recycling capital, so each one of these transactions, if you take out $9500, take out $10,000, and you’re paying just over $1,600 for that invoice, we then receive that payment and then lend that out again. And so, we’re able to earn multiple fees on every single deal that we have outstanding. And it’s the way in which a lot of these lending platforms work. And ultimately, the goal is really to return that to our end borrower and the ability to decrease the costs of funds and able to pay up front for these large software purchases that they wouldn’t be able to afford previously.

Nathan: Guys, are you following along? This is a very smart FinTech guy. Knows all the numbers and understand that it comes from it. So, just to make the math very easy, right? If you’ve got a $10 million facility, he’s got a great product going to market that makes everyone’s life easier on both sides. If you can deploy 10 million bucks at a blended cost of 12% and he’s able to earn 25%, we’re recycling that capital quickly as the monthly payments come back. It’s effectively yield of almost 12% to 13% on 10 million or about a $1.2 to $1.3 million run rate. Right, Baxter?

Baxter: That’s exactly right, Nathan. I think you may be smarter than I am.

Nathan: No, hell no. But the question is, right, can you keep redeploying all those payments as they come back as your fund grows to $100 million and a billion, you’re gonna be getting payments back monthly that are million and then $10 million, like can you get them out quick enough, right?

Baxter: That’s exactly right. Capital efficiency in any of these lending businesses and within any fintech models is super important. And I think the core of the product, which is even more important is, how do you drive value for your partners and end customers. And that’s really what we’re more focused on as opposed to capital efficiency in these early days. It’s how can we create a software solution that drives value and is a win-win solution for both Salesforce and their end customer who are doing it today, but the goal is to keep that up, keep the innovation, keep the technology, machine moving, and really advance the b2b payments space, which as we all know is very antiquated.

Nathan: Couple rapid fire. So, here, we’re out of time, but because I love this business model, so I lost track of time, but quick stuff here. You raised equity, that $5 million you raised last year?

Baxter: We raised that in Q3 of last year.

Nathan: Q3 last year. Okay. Cool. And I mean, that was your first capital and right, that’s your only capital on equity sidewise?

Baxter: Yeah. I invested a little bit of money personally in the business to really get it off the ground. But that was our kind of first, call it third party institutional race.

Nathan: Okay. Are you the sole cofounder or sole founder?

Baxter: Yes.

Nathan: Okay. We love that. So, he knows he’s onto something big. He says, I’m going to risk my own capital, I want to keep 100%. I’m going to be very – manage the cap table. That’s great. Now Baxter, was that money you initially put in, did you structure it as a loan? Or was that real equity?

Baxter: That was real equity.

Nathan: I was gonna say, the real extreme example was, do you loan your own company that money, you raise the $5 million and you take that back. You got into junior tranche, like you’re on all sides of this thing, which is great. Okay, but it’s your own money. So, $5 million raised last year pre-seed round, we’ll see what happens next. Just to be clear, you haven’t deployed $10 million yet. So, you’re under a $1.2 million run rate, but you think you can break that fairly quickly if you deploy the capital?

Baxter: Yeah, we should be able to hit that pretty quickly. I think you know, the goal is continuing to go to market and continue to get our value prop out there. I ultimately think that, b2b payments is a trillion-dollar industry. And every single b2b company, whether its software, services will have flexible pricing solutions. You know, we can’t live in a world in which pay by ACH and pay by Wire are the only two solutions for checking out for a $10,000 payment or $2 payment. And there’s just going to be a tremendous amount of innovation in this space. And it’s a really, really exciting space to be in.

Nathan: Team size today. How many people?

Baxter: 13.

Nathan: And how many engineers?

Baxter: Nine.

Nathan: Now, okay, there we go. So, when he says there’s tech behind it, there’s tech behind it. There’s nine engineers, there you go. That’s, proof is in the pudding. Right. Very cool, Baxter. Let’s wrap up here with the Famous Five. Number one, Favorite book?

Baxter: Shoe Dog.

Nathan: Number two, the CEO you’re following or studying?

Baxter: Frank Slootman.

Nathan: No. Okay, it’s a hell of a business. Can you do this on utility-based pricing? I mean, Snowflake, really, I would argue is not SaaS, it’s actually utility-based pricing. It changes every month.

Baxter: Utility-based pricing is a really, really interesting model. I think Snowflake’s perfected that just given their ability to innovate and market position in the space. For our specific business model, I think you may be able to, but it will be challenging.

Nathan: Yeah. And maybe it’s the future. Who knows? Number three, what’s your favorite online tool for building Alternative?

Baxter: Notion.

Nathan: Number four, how many hours of sleep do you get every night?

Baxter: Six to seven.

Nathan: And what’s your situation? Married, single, kids?

Baxter: Fiancé, getting married in August.

Nathan: Oh, very exciting. Okay, but no kids, right?

Baxter: No kids.

Nathan: All right. And how old are you, Baxter?

Baxter: I am 32.

Nathan: Last question. Something you wished you knew when you were 20?

Baxter: Try everything that’s in front of you. I think there’s a continued push to really broaden your horizons and take advantage of all the opportunities I think especially on the entrepreneurship side, you really need to start the business you don’t think you can and go for the stars and get that experience even if it doesn’t turn into something because the future’s bright.

Nathan: Guys, he cut his teeth at Victory Park and Apollo, launched last year in 2020. He said there’s got to be a better way if you’re SMB and want to use Salesforce and can’t pay $10k up front. There’s got to be a better way to do it. That’s what he’s built with alternative.co. He’s funded himself right raising a $5 million equity round last year in addition to $10 million of debt. He’s deploying that capital, that debt at cost of capital, him about 12% to 13%. And if he can lend it, keep the waterfall going, keep recycling that money and earn 25% of the yield, there is about 12% or 13% or about a $1.2 million run rate as he continues to scale. We’ll see what happens, 10 enterprise b2b SaaS companies and service companies using him to help give their customers more payment options which helps them grow their own revenue faster. Team of 13 today, we’ll see what happens next. Baxter, thanks for taking us to the top.

Baxter: Thanks so much. Really appreciate it, Nathan.