Key Takeaways

- MSPs can reduce Days Sales Outstanding (DSO) from 50-60 days to under 30 days with payment automation

- Automated payment systems can help reduce receivables from $80,000 to $4,000 in just months

- Integration with PSA tools and QuickBooks streamlines financial operations

- Payment automation enables 61% client activation rates for electronic payments

- Proper implementation can reduce billing-related support tickets by eliminating manual reconciliation

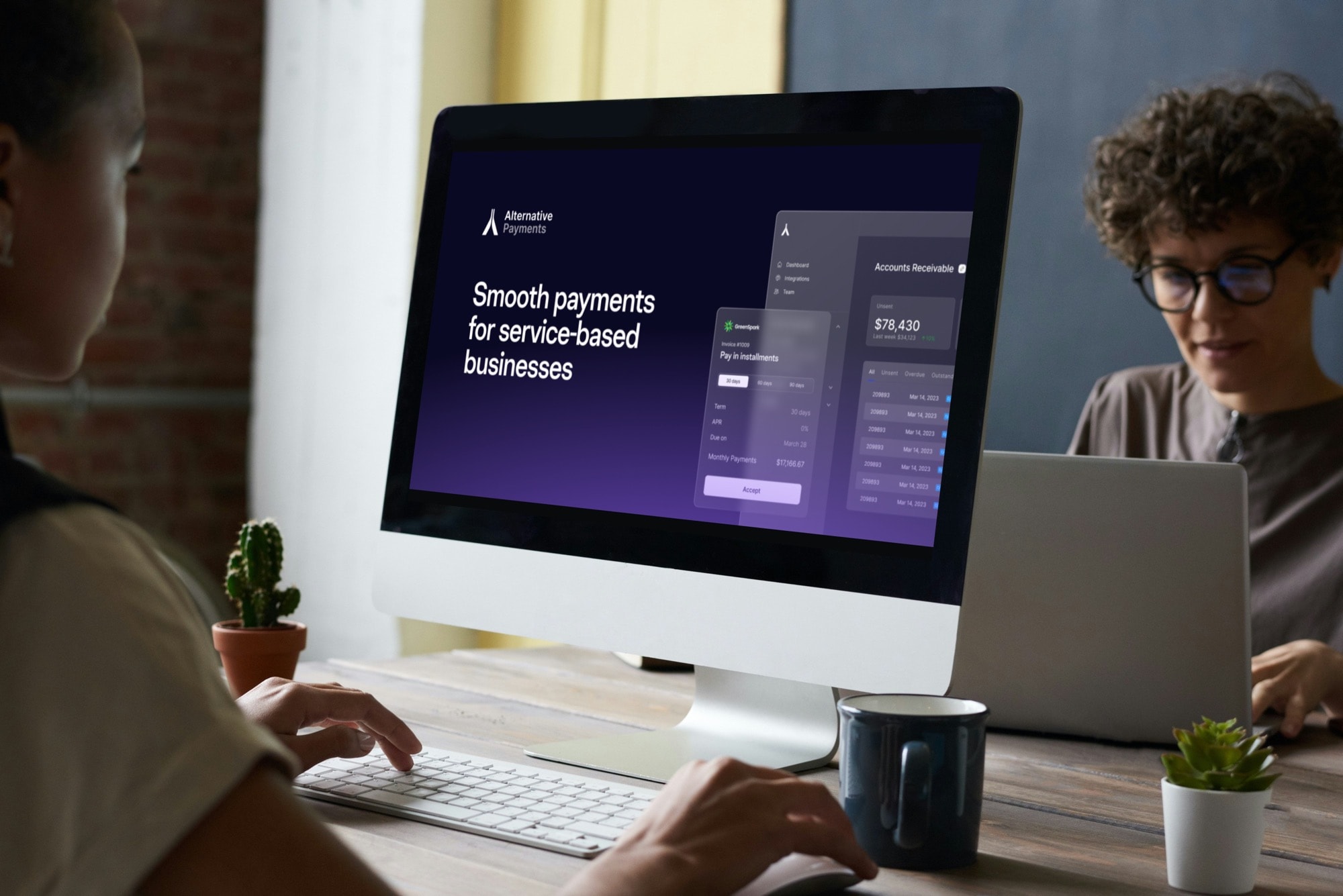

Executive Summary

Payment automation has emerged as a critical growth enabler for Managed Service Providers (MSPs), with documented cases of 50% reduction in payment cycles and 95% reduction in outstanding receivables. This article examines how payment automation systems drive MSP growth through improved cash flow, reduced administrative overhead, and enhanced client satisfaction. For the business owner, understanding and implementing these systems is crucial for scaling operations effectively. Drawing from real MSP experiences, we explore the concrete benefits, implementation strategies, and best practices for leveraging payment automation to scale operations effectively.

Challenges of Scaling an MSP

Scaling a Managed Service Provider (MSP) business comes with its own set of challenges. One of the primary hurdles is managing growth while maintaining high-quality metrics. As the client base expands, it becomes increasingly difficult to ensure that the level of service remains consistent, especially if the business is not adequately prepared for the growth.

Another significant challenge is finding and retaining skilled technicians and engineers who can deliver top-notch services to clients. The demand for qualified IT professionals is high, and MSPs must compete with other businesses to attract and keep the best talent. Additionally, managing multiple vendors and technologies can be both time-consuming and costly, adding another layer of complexity to the business operations.

Furthermore, MSPs must stay agile and adaptable to keep up with changing market trends and emerging technologies. This requires continuous learning and investment in new tools and systems, which can be a daunting task for any business. However, overcoming these challenges is crucial for MSPs to scale successfully and maintain their competitive edge in the market.

Streamlined Financial Operations for Accounts Payable Department

Payment automation significantly reduces the time and resources required for billing and collections. The accounts payable department plays a crucial role in enhancing efficiency and reducing costs by streamlining processes, optimizing cash management, and integrating modern automation technologies. This efficiency allows MSPs to handle a growing client base without proportionally increasing their administrative staff.

As Eric Peterson of Simple Communications notes, “It was the easiest transition I’ve ever made with any system… I should have done it months earlier.” His experience demonstrates the immediate impact: reducing accounts receivable from $80,000 to $4,000 within just two months of implementation.

For MSPs, time is a precious commodity. Every hour spent on manual billing processes is an hour not spent on strategic growth initiatives, client relationship management, or service improvement. By automating these processes, including the use of cost-effective and efficient ACH transfers, you’re not just saving time; you’re reallocating it to high-value activities that drive business growth.

Improved Cash Flow Management and Prevention of Duplicate Payments

Automated systems ensure timely invoicing and faster payment collection, crucial for maintaining healthy cash flow as your business expands. Integrating ACH transfers into payment automation tools can reduce costs and labor, while ensuring fast and accurate payments, ultimately enhancing relationships with vendors. The impact is substantial – MSPs report reducing their Days Sales Outstanding (DSO) from 50-60 days to under 30 days after implementing ACH systems, which securely transfer funds from one account to another.

“Between May and now, you can see the drastic improvement on cash flow… It made a tremendous difference,” reports Eric Peterson. This improvement in cash flow directly impacts an MSP’s ability to invest in growth initiatives and maintain healthy operations.

Automated payment systems address cash flow challenges through:

- Faster invoicing with immediate generation and delivery

- Multiple payment options increasing client convenience

- Automated payment reminders reducing follow-up time

- Consistent payment timing improving cash flow forecasting

- Reduced DSO freeing up capital for growth initiatives

Enhanced Client Satisfaction

Client satisfaction extends beyond technical service delivery to include the entire business relationship, including billing processes. Enhancing vendor relationships through automation can improve communication with vendors and reduce errors, fostering satisfaction and trust. As Eric Peterson observes, “My clients like it. They think the portal is nice and cleaner, easier to navigate.” One client managing eight different entities particularly praised the system’s ability to view all accounts in a single portal.

Raffi Jamgotchian of Triada Networks adds, “It’s simplified our workflow and made things easier on our clients. Those are two huge wins for us.”

Integration Capabilities

A key factor in successful payment automation is seamless integration with existing business systems. MSPs report significant benefits from integration with:

- Professional Services Automation (PSA) platforms

- QuickBooks and accounting software

- Client portals and management systems

As Raffi Jamgotchian notes: “We create an invoice in our PSA, the PSA pushes it into QuickBooks, and when we send out the QuickBooks invoice, it has the link to Alternative Payments. It’s simplified our workflow and made things easier on our clients.”

The elimination of manual reconciliation and multiple system management has proven particularly valuable. “My accountant loves it because they clear themselves. The payment comes in, it marks itself paid in QuickBooks, so she doesn’t have to do it anymore,” reports Eric Peterson.

Security and Compliance

Payment automation software ensures PCI-DSS compliance through:

1. Data Encryption

- End-to-end encryption of payment data

- Secure storage of payment information

- Tokenization of sensitive data

2. Access Controls

- Role-based access management

- Multi-factor authentication options

- Audit logging and monitoring

3. Compliance Documentation

- Automated compliance reporting

- Regular security assessments

- Documentation maintenance

4. Industry Standards

- SOC 2 Type II certification

- NIST framework alignment

- Regular security updates

Overcoming Payment Automation Challenges

While payment automation can revolutionize business operations, it also presents its own set of challenges. One of the primary issues is ensuring that the payment automation system integrates seamlessly with the company’s existing enterprise resource planning (ERP) system. This integration can be complex, especially if the ERP system is outdated or not fully compatible with the new payment automation technology.

Security and compliance are also critical concerns. The payment automation system must adhere to relevant regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), to protect sensitive payment information. Ensuring robust security measures, such as data encryption and access controls, is essential to prevent breaches and maintain client trust.

Another challenge is managing duplicate payments, which can occur if the system is not properly configured. Duplicate payments can lead to financial discrepancies and require additional resources to resolve. To mitigate this risk, businesses should work with reputable payment automation providers and implement thorough testing and validation processes.

By addressing these challenges head-on and ensuring that the payment automation system is well-integrated, secure, and reliable, businesses can fully leverage the benefits of payment automation. This includes improved efficiency, reduced human error, and enhanced cash flow management, all of which contribute to the overall growth and success of the business.

Client Onboarding Process

Implementation Timeline

Week 1:

- Initial system setup

- Team training

- Integration configuration

Week 2:

- Client communication

- Portal setup

- Payment method migration

Week 3:

- Client training

- Payment testing

- System verification

Implementation Checklist

Pre-Implementation:

- □ System requirements review

- □ Integration planning

- □ Team training schedule

- □ Client communication strategy

Implementation:

- □ System configuration

- □ Integration testing

- □ Payment method setup

- □ Client data migration

Post-Implementation:

- □ Client training

- □ Payment verification

- □ Support documentation

- □ Success metrics tracking

ROI Analysis

Based on case study data:

Initial Investment:

- Implementation costs: $2,000-5,000

- Monthly fees: $200-500

- Training time: 8-16 hours

Returns:

- DSO reduction: 50% (from 60 to 30 days)

- Staff time savings: 15-20 hours/month

- Reduced receivables: Up to 95%

- Improved cash flow: $50,000-80,000

Payback Period: 2-3 months

Choosing the Right Payment Automation Solution

Key Considerations

1. Integration Capabilities

- PSA compatibility

- Accounting software integration

- API availability

2. Feature Set

- Multiple payment methods

- Automated reconciliation

- Client portal functionality

- Reporting capabilities

3. Security and Compliance

- PCI-DSS compliance

- Data encryption

- Access controls

4. Cost Structure

- Implementation fees

- Monthly charges

- Transaction costs

- Volume pricing

5. Support and Training

- Implementation assistance

- Ongoing support

- Training resources

- Documentation

Conclusion

Payment automation is a strategic asset for MSP growth, delivering documented improvements in cash flow, operational efficiency, and client satisfaction. The experiences of MSPs like Simple Communications and Triada Networks demonstrate that proper implementation can transform financial operations and support sustainable growth.

With potential DSO reductions of 50% and activation rates exceeding 60%, payment automation provides a clear path to improved financial performance and scalability. As the MSP industry continues to evolve, automated payment systems will remain a crucial tool for companies looking to grow efficiently and maintain competitive advantage.