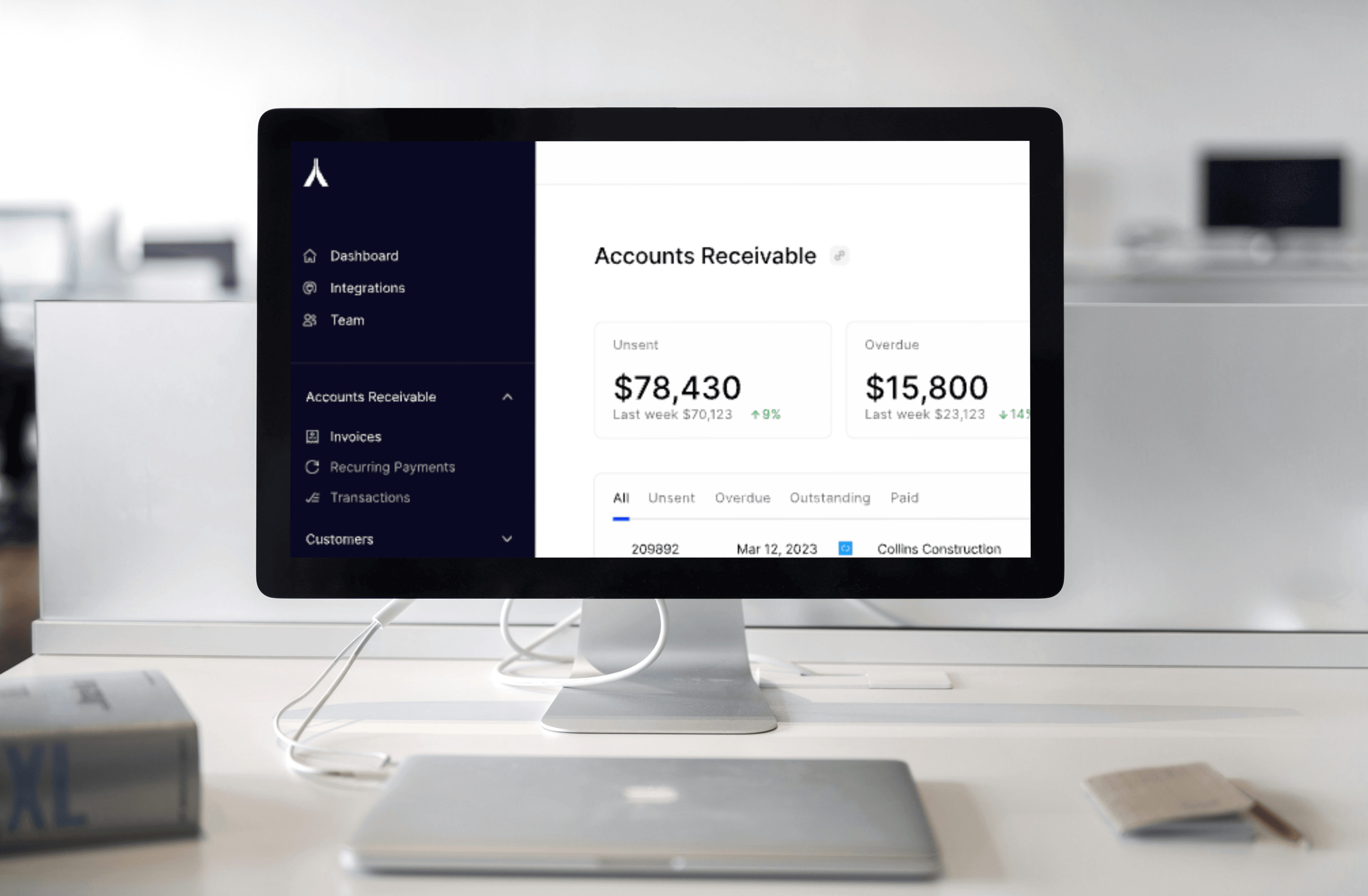

Alternative Payments doesn’t just enhance security and compliance; it significantly improves an MSP’s operational efficiency and financial health. Let’s look at some concrete numbers that demonstrate the impact of our platform:

Dramatic Reduction in Late Payments

Late payments can cripple an MSP’s cash flow and operations. Our data shows a stark contrast between MSPs using Alternative Payments and those using traditional methods:

- Outside our platform, 20.5% of invoices remain overdue.

- With Alternative Payments, only 6.7% of invoices remain overdue.

Moreover, we’ve seen a significant increase in on-time and early payments:

- Without our platform, only 37.5% of invoices were paid before the due date.

- With Alternative Payments, 61% of invoices are paid on or before the due date.

These figures demonstrate how our platform can transform an MSP’s accounts receivable process, ensuring more predictable cash flow and reducing the stress of chasing late payments.

Substantial Improvement in Cash Flow

The impact of reducing late payments on an MSP’s cash flow is substantial. Let’s consider a typical scenario:

For an MSP with $10 million in annual revenue and a 30-day DSO (Days Sales Outstanding), reducing the DSO to 15 days can increase cash flow from $1 million to $1.41 million – a 41% increase.

Even more impressively, our customers using Alternative Payments achieve an average DSO of just 5 days. This can boost cash flow to $1.68 million – a remarkable 68% increase.

This additional cash flow can be reinvested into the business, used to hire new talent, or invested in new technologies to serve clients better.

Reduction in Outstanding Invoices

While we can’t calculate exact revenue figures, we can provide insight into invoice volume. Our data shows that 21% of invoice volume due in a given month remains overdue today (this figure includes both Alternative Payments and external systems).

This highlights the ongoing challenge MSPs face with late payments and underscores the value of a system that can significantly reduce this percentage.

Time Savings Through Automation

One of the most tangible benefits of Alternative Payments is the time saved through automation. We estimate that MSPs save between 5-10 hours per month by automating their billing processes with our platform.

This time saving comes from eliminating manual processes such as:

- Sending initial invoices

- Following up on unpaid invoices (sometimes requiring 5-10 attempts)

- Providing payment support and troubleshooting

- Cashing checks

- Reconciling payments

By automating these processes, MSPs can redirect their staff’s time to more valuable activities, such as improving service quality or pursuing new business opportunities.

Translating Numbers into Real-World Benefits

These statistics paint a clear picture of how Alternative Payments can transform an MSP’s financial operations. Let’s break down what these statistics mean in practical terms for MSPs:

- Improved Cash Flow Management: With Alternative Payments, 61% of invoices are paid on or before the due date, compared to just 37.5% without our platform. This 23.5% increase in on-time payments can significantly smooth out cash flow fluctuations.

- Reduced Financial Stress: Our platform reduces overdue invoices from 20.5% to just 6.7%. For an MSP with $1 million in monthly invoices, this means $138,000 less in overdue payments to chase each month.

- Enhanced Client Relationships: By automating billing processes, MSPs save 5-10 hours per month on payment-related tasks. This time can be redirected to improving client services and communication.

- Increased Focus on Core Business: With a reduction in DSO from 30 days to just 5 days, MSPs can see their available cash flow increase by 68%. For a $10 million revenue MSP, this translates to an additional $680,000 in working capital.

- Competitive Advantage: MSPs using Alternative Payments have 79% of their invoices paid on time or early, compared to only 37.5% for those not using our platform. This financial stability can allow for more competitive pricing or increased investment in service quality.

- Time and Resource Savings: By eliminating manual processes like sending invoices, following up on payments, and reconciling accounts, MSPs can save up to 120 hours annually. At an average rate of $100 per hour for financial staff, this represents $12,000 in annual labor savings.

These figures demonstrate that Alternative Payments isn’t just a tool for processing payments – it’s a comprehensive solution that can transform an MSP’s financial operations, freeing up resources and capital for growth and improved service delivery.