We are in the era of rapid digital transformation. Businesses seek innovative tools and alternative, unique strategies, to optimize processes, and drive revenue growth. When it comes to streamlining financial operations, accounts receivable software, has not broken the mainstream seal.

This is the solution that you need to learn more about and can have an immediate, direct impact on your business. Are you asking yourself, “Wait really?” Bear with me and you’ll see what I’m talking about.

Embracing Change in Financial Operations

Gone are the days of growth at all costs. We all spend so much money chasing down those closed won deals, but what are we doing to manage not just the relationship, but the actual execution of the payment?

You know, the actual functionality and assurance you’re being paid on time. Don’t be too worried or embarrassed how something so seismic could have slipped your radar while you’re spending 6 or 7 figures on the tech and other customer acquisition costs to acquire that revenue.

Streamlined Efficiency and Error Reduction

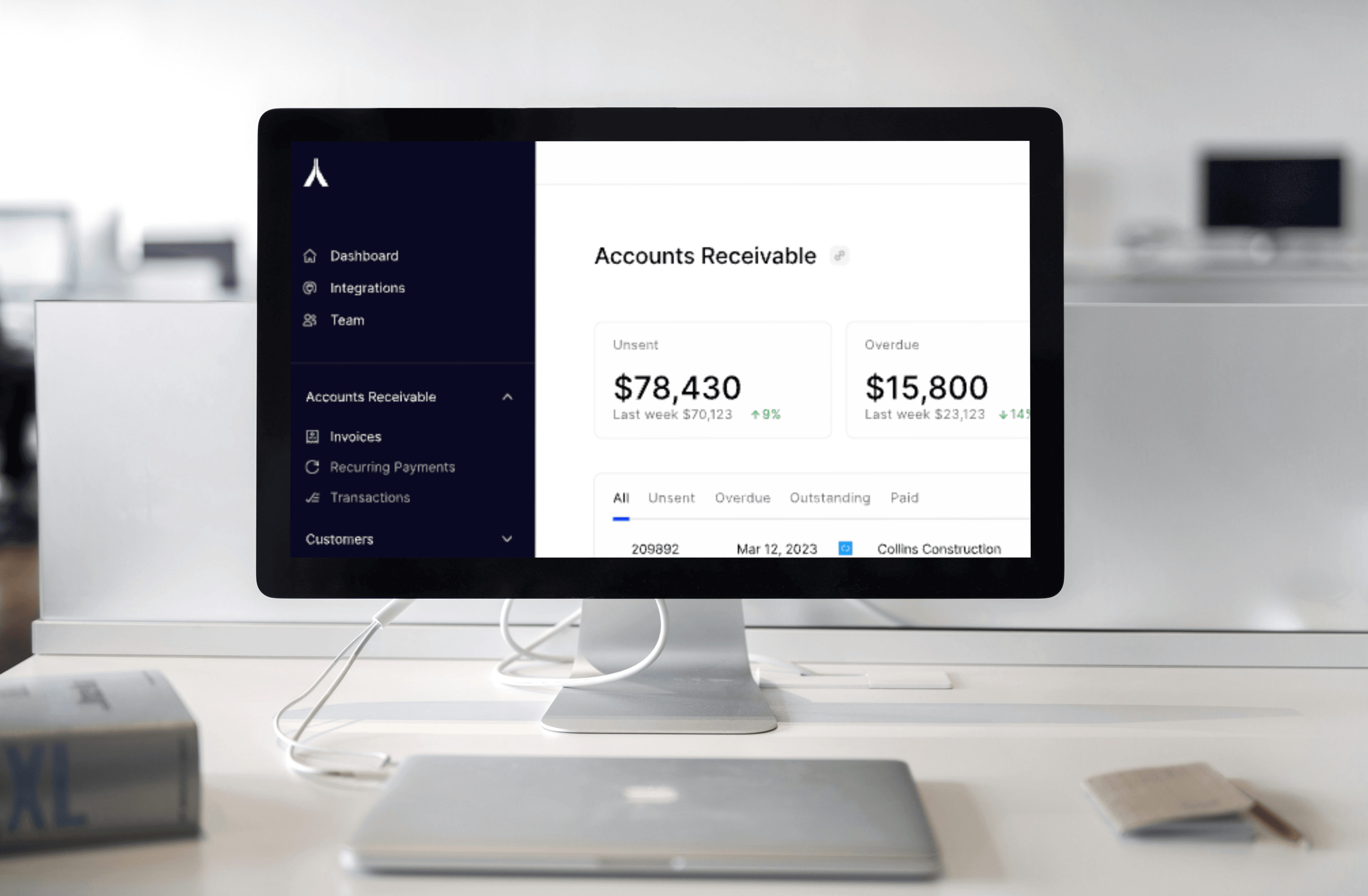

The time of manual billing systems with their tedious processes and room for errors is truly in the past. To paint the picture, we don’t want one foot stuck in cement as the rest of our body is being yanked in the other direction. Accounts receivable software has evolved into a mission-critical tool that offers unparalleled efficiency by simplifying the billing process.

With automation infused into your billing and payment ecosystem, your organization will find itself minimizing errors, enhancing operational efficiency, and saving valuable time and resources. Say goodbye to day after day melted away and spent on manual data entry because you now say hello to streamlined, error-free invoicing.

What is Accounts Receivable Software?

The benefits of accounts receivable software extend beyond just operational efficiency. By leveraging an AR platform like Alternative Payments, businesses can gain valuable insights into their financial processes, identify potential bottlenecks, and then apply that calculus to implement unique and differentiated revenue growth strategies.

Using accounts receivable software goes beyond just improving operational efficiency. It helps you understand your finances, spot problem areas, and develop creative ways to increase your revenue. The truth is that SaaS management and accounts payable software alike have garnered the headlines, and it’s largely because of bloated and mismanaged software spending coupled with a recessionary economy that has given way for important solutions, but not mission-critical.

Understanding the basics

What is accounts receivable software? That’s the question you need to answer first. Taking it back even further, what is accounts receivable? Is it simply the amount of money that a company is waiting to receive from its customers for goods or services? It’s nothing to worry about, and it’s listed on the balance sheet as a current asset. AR is just the outstanding balance owed to the business for purchases made on credit.

The hyper-digitized epoch of today demands staying ahead of the competition, which requires embracing new technologies and innovative solutions. Do you feel yourself getting left behind? Don’t worry, it’s not too late to discover the power of accounts receivable software and unlock the true potential of your business.

Ready to revolutionize your financial processes? Let’s connect and explore how accounts receivable software can transform your business today!