Of all the tools in your finance team’s tool kit, accounts receivable automation tackles the strain of limited internal bandwidth and the tedious process of getting invoices paid. And yet, many organizations march forward, blindly, with manual billing practices. While we may credit the comfort of the status quo and unwillingness to evolve as the roots of the problem, consider the precious waste of time and money.

According to Alternative Payments B2B Payments Trends Report, 30% of business invoices are 90 days past due.

Automated payments have become increasingly popular due to the time-savings they offer to both companies and their customers, not to mention the improved cash flow back into the company’s coffers. Invoicing and payments will eventually become fully automated. This is why businesses must educate themselves on implementing this technology and embrace its value.

What is Accounts Receivable Automation?

Accounts receivable automation applies advanced software solutions to simplify invoicing, billing, and collection processes related to receivables management. Automation helps businesses with repetitive and time-consuming tasks, standardizing workflows, and providing real-time insights into their receivables. This, in turn, enhances the efficiency of their financial operations.

The Digital Transformation is Alive and Well

The digital transformation has been rapidly taking place across various B2B verticals. IoT (Internet of Things) has led to a hyperconnected cloud environment. On the other hand, IIoT (Industrial Internet of Things) has brought in Industry 4.0, a topic of discussion that has spanned for years. While it all does evoke an air of altruism, these buzzwords are very closely associated. They aim to improve efficiency, reduce expenses, and increase revenue.

In recent years, with the complexity and dependability of automation, new concepts have emerged. For instance, human automation, or, the absolute scalability of human work, and dark factories, which is the idea of factories with no human presence, hence the term “dark”.

See the 2024 B2B Payments Trend Report: Alternative Payments reduces DSO to a 6-day average compared to the 43-day industry standard

How Automation Unlocked Simplicity and Instant Cash Flow

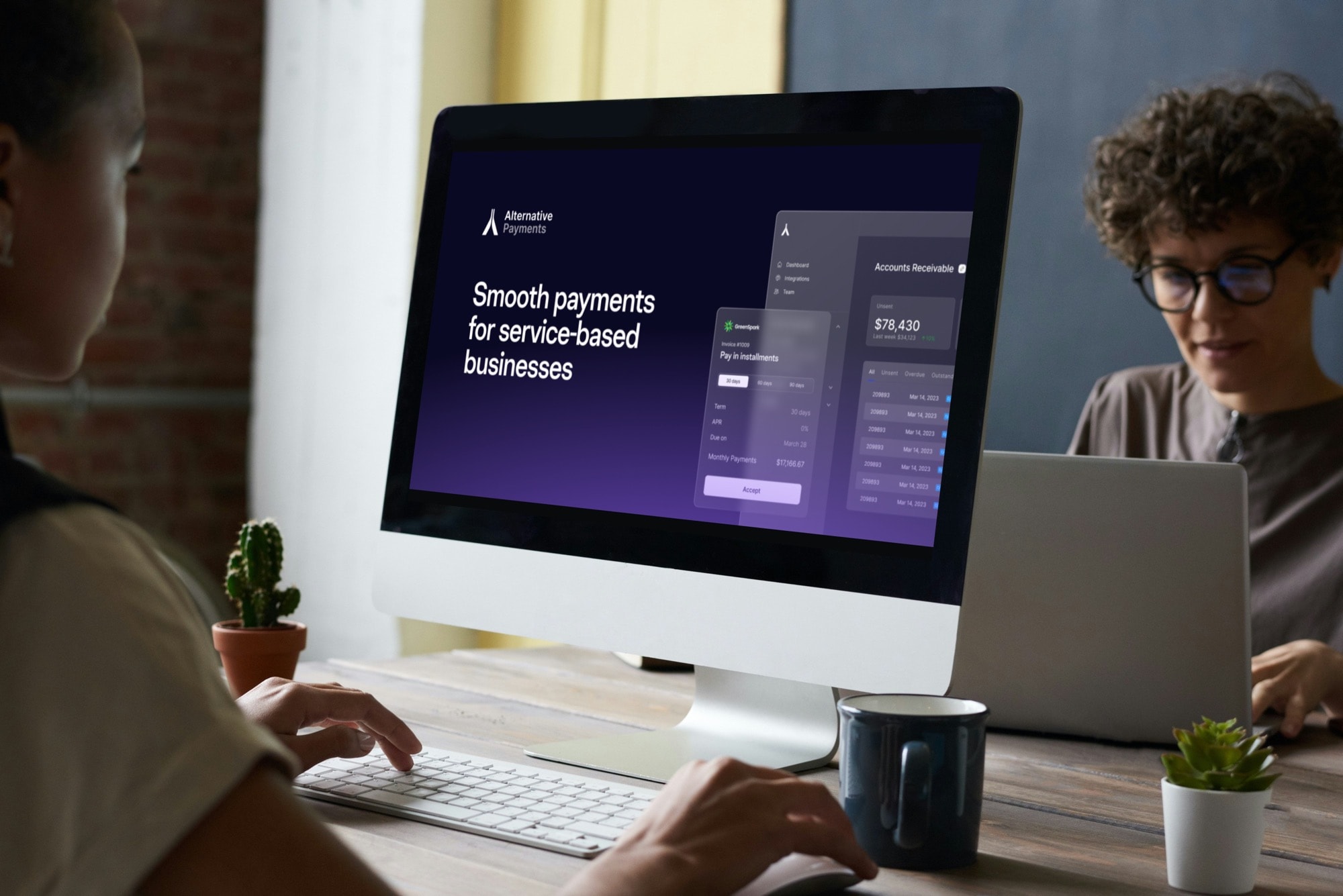

The benefits are immeasurable for companies that invest in accounts receivable automation. Heiden Technology, a managed service company, wanted to simplify payment processing and automate manual tasks to get paid quicker. Like most organizations, their accounts receivable ecosystem was rooted in manual processes. Before implementing automation through Alternative Payments, all inbound payments were executed via paper checks or over the phone, significantly hindering their cash flow and days sales outstanding (DSO).

The Impact Heiden Saw After Implementation

Through the implementation of Alternative Payments automation features, they enhanced and streamlined their payment process. This included:

- Simplified customer payments with Alternative’s payment portal

- Automating payments and transaction reconciliation is giving back hours and hours each week to individuals on these workflows

- Their average payment collection time is now benchmarking 29 days faster than the industry average

Heiden accelerated their collection time by 50% upon implementing AR automation and moving away from a manual billing process. Leaning into automation is increasingly critical for businesses that hope to sustain themselves in this ongoing economic climate. The reality is that by tactically and strategically leveraging automation you can access time and money at a scale you never before thought was possible. Learn more about how Heiden Technology positively benefited from partnering with Alternative Payments in this case study.

Alternative Payments Automations makes automating your accounts receivable processes a breeze with key features like auto-pay.

How can accounts receivable automation help companies optimize working capital?

Alternative Payments offers comprehensive accounts receivable features that streamline payments and facilitate instant cash flow through auto-pay and auto-reconciliation capabilities. Businesses that recently joined the platform experience a 26% increase in payment automation in the first month, which gradually ramps to 41% by the sixth month due to process adjustments, education, and time investment for both businesses and their customers.

AR automation is becoming increasingly paramount for B2B brands. By adopting automation in receivables management, businesses are improving efficiency, accuracy, and growth in their payment process. They can dynamically reallocate resources to accelerate other focus areas — soon enough they will find themselves outpacing the competition.

Modern AR Automation

The new demands within the modern B2B landscape extend beyond saving time and money.

- Skip manual work: AR automation software eliminates paper invoices and manual data entry, saving countless hours.

- Improve collection rates: Consider setting up basic auto-pay rules to eliminate overdue payments; therefore, reducing the time it takes for collections. This helps avoid late fees and improve credit scores.

- Grow your revenue: Your time is your most valuable asset — make the most of it by focusing on growing your business.

How do I know if accounts receivable automation is right for my business?

AR automation is a solution that can help businesses optimize and modernize their billing and invoicing practices, reduce the workload on internal staff, and accelerate transaction processing and cash flow timing.

Accounts receivable processes will vary from organization to organization, but these are all functional areas that many organizations could improve upon. While every company and situation is unique, assessing your current payment processing system and accounts receivable processes is crucial. This will help you understand how technology can enhance your workflow and elevate your business to the next level.

Alternative Payments simplifies payment automation and accounts receivable for businesses. Leap into the future of automation, and learn how we can revolutionize your business today!